2018-10-19 13:37:00 Fri ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

PayPal earns great fintech reputation from its massive worldwide network of 250+ million active users. As PayPal beats the revenue and profit expectations of most stock analysts and economic commentators in 2018Q3, its share price surges 9%. A peer-to-peer payment app, Venmo, enjoys 80% growth in total payment volume quarter-to-quarter. As this M&A brain child proves to be a major moneymaker for its parent company PayPal, Venmo adds 9 million peer-to-peer payment accounts to the PayPal mafia worldwide network.

PayPal now continues to expand its strategic partnership with Visa, MasterCard, American Express, Apple, Google, Samsung, and Walmart to allow cardholders to use their membership points when these consumers shop from PayPal merchants. This additional convenience empowers key consumers to integrate their electronic retail experiences with most traditional credit cards. Anecdotal evidence suggests that PayPal encompasses more than 250 million active members with about 78% of the total market share in America.

Key stock analysts and economic media commentators expect the eBay multi-year transition to the Adyen fast-payment platform to be quite bumpy in light of the long history that both buyers and sellers have almost exclusively interacted with PayPal on the prior eBay online auction platform. In hindsight, the Dutch payment platform Adyen can be a cost-effective key option for eBay, but eBay might have overlooked the tremendous positive network effects of PayPal that dominates in the electronic mobile payment market in America.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2023-05-27 11:30:00 Saturday ET

Bank failure resolution and financial risk management: Silicon Valley Bank, Signature Bank, and First Republic Bank. What are the main root cau

2019-09-09 20:38:00 Monday ET

Harvard macrofinance professor Robert Barro sees no good reasons for the recent sudden reversal of U.S. monetary policy normalization. As Federal Reserve Ch

2018-04-23 07:43:00 Monday ET

Harvard professor and former IMF chief economist Kenneth Rogoff advocates that artificial intelligence helps augment human productivity growth in the next d

2019-01-09 07:33:00 Wednesday ET

Apple revises down its global sales revenue estimate to $83 billion due to subpar smartphone sales in China. Apple CEO Tim Cook points out the fact that he

2019-01-17 10:41:00 Thursday ET

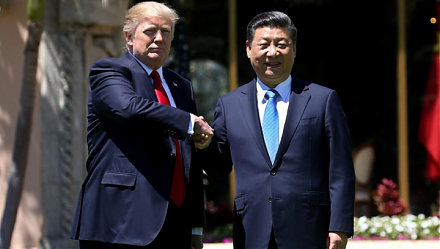

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu

2019-01-04 11:41:00 Friday ET

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin