2019-09-13 10:37:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

China allows its renminbi currency to slide below the key psychologically important threshold of 7-yuan per U.S. dollar. A currency dispute between the U.S. and China has brought the trade conflict between the G2 superpowers to new extremes. U.S. Treasury designates China a currency manipulator soon after the Chinese central bank lets renminbi slide to the symbolically important level of 7-yuan per U.S. dollar for the first time in 11 years. This strategic move represents another escalation as the Sino-U.S. trade relations continue to deteriorate in the meantime.

On the one hand, this recent renminbi depreciation renders Chinese export prices more competitive and so can contribute to better trade-driven economic prospects. On the other hand, the renminbi depreciation inevitably exacerbates the monetary severity of 25% tariffs on $250 billion Chinese imports. This renminbi depreciation serves as a flexible countermeasure to the 10% Trump tariff on all the other $300 billion Chinese imports, and most U.S. stock market indices decline substantially 3%-5% in response to the bilateral tense trifecta of tech, trade, and currency. U.S. Treasury Secretary Steven Mnuchin indicates that the Trump administration can engage with the IMF, WTO, and World Bank to deter unfair trade competition from China.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-05-21 04:27:10 Wednesday ET

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc

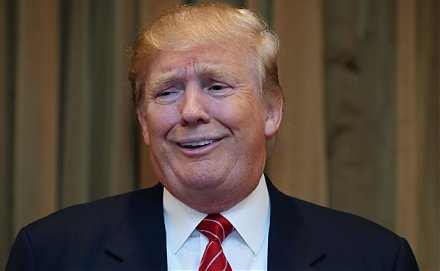

2017-06-15 07:32:00 Thursday ET

President Donald Trump has discussed with the CEOs of large multinational corporations such as Apple, Microsoft, Google, and Amazon. This discussion include

2018-12-15 14:38:00 Saturday ET

Google CEO Sundar Pichai makes his debut testimony before Congress. The post-mid-term-election House Judiciary Committee bombards Pichai with key questions

2018-08-27 09:35:00 Monday ET

President Trump and his Republican senators and supporters praise the recent economic revival of most American counties. The Economist highlights a trifecta

2019-01-12 10:33:00 Saturday ET

With majority control, House Democrats pass 2 bills to reopen the U.S. government without funding the Trump border wall. President Trump makes a surprise Wh

2020-11-10 07:25:00 Tuesday ET

The McKinsey edge reflects the collective wisdom of key success principles in business management consultancy. Shu Hattori (2015) The McKins