2019-09-13 10:37:00 Fri ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

China allows its renminbi currency to slide below the key psychologically important threshold of 7-yuan per U.S. dollar. A currency dispute between the U.S. and China has brought the trade conflict between the G2 superpowers to new extremes. U.S. Treasury designates China a currency manipulator soon after the Chinese central bank lets renminbi slide to the symbolically important level of 7-yuan per U.S. dollar for the first time in 11 years. This strategic move represents another escalation as the Sino-U.S. trade relations continue to deteriorate in the meantime.

On the one hand, this recent renminbi depreciation renders Chinese export prices more competitive and so can contribute to better trade-driven economic prospects. On the other hand, the renminbi depreciation inevitably exacerbates the monetary severity of 25% tariffs on $250 billion Chinese imports. This renminbi depreciation serves as a flexible countermeasure to the 10% Trump tariff on all the other $300 billion Chinese imports, and most U.S. stock market indices decline substantially 3%-5% in response to the bilateral tense trifecta of tech, trade, and currency. U.S. Treasury Secretary Steven Mnuchin indicates that the Trump administration can engage with the IMF, WTO, and World Bank to deter unfair trade competition from China.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-01-23 09:30:00 Monday ET

There are several highlights from the first news conference after Trump's presidential election victory: The Trump administration will repeal-and-

2022-10-05 08:24:00 Wednesday ET

Precautionary-motive and agency reasons for corporate cash management Bates, Kahle, and Stulz (JF 2009) empirically find that public firms have doubled t

2025-09-16 09:27:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2017-04-25 06:35:00 Tuesday ET

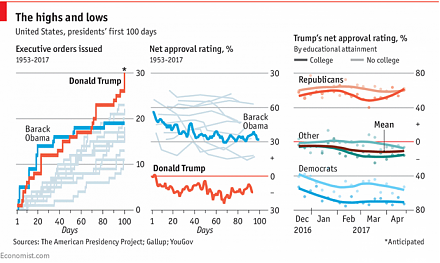

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2018-07-21 13:35:00 Saturday ET

President Trump supports a bipartisan bill or the Foreign Investment Risk Review Modernization Act (FIRRMA), which effectively broadens the jurisdiction of

2017-03-15 08:46:00 Wednesday ET

The heuristic rule of *accumulative advantage* suggests that a small fraction of the population enjoys a large proportion of both capital and wealth creatio