2022-11-15 10:30:00 Tue ET

mergers acquisitions corporate finance baker and wurgler managerial entrenchment jarrad harford corporate governance corporate investment corporate social responsibility rent protection ceo overconfidence board connections capital expenditures david hirshleifer ronald masulis andrei shelifer lucian bebchuk ulrike malmendier

The behavioral catering theory suggests that stock market misvaluation can have a first-order impact on major corporate investment and payout decisions while corporate incumbents cater to peculiar investor preferences (such as dividend initiations or omissions, local dividend clienteles, and short-term overinvestments).

Relative market misvaluation between the bidder and target firms drives most waves of mergers and acquisitions (Loughran and Vijh, JF 1997; Shleifer and Vishny, JFE 2003). Highly valued bidder firms are more inclined to use stock rather than cash as consideration in mergers and acquisitions (Dong, Hirshleifer, Richardson, and Wong, JFE 2006).

Dong, Hirshleifer, Richardson, and Wong (JFE 2006) and Masulis, Wang, and Xie (JF 2007) confirm Loughran and Vijh's (JF 1997) empirical evidence on cash and stock acquisitions. Cash tender offers attract significantly positive cumulative abnormal returns around the acquisition announcement date. Stock acquisitions attract significantly negative cumulative abnormal returns around the acquisition announcement date.

Polk and Sapienza (RFS 2009) find a significantly positive relationship between abnormal investment and discretionary accrual (the latter of which is a proxy for the degree of market misvaluation). This pattern is more pronounced for firms with greater opacity (low asset tangibility or high R&D intensity) and investor short-termism (high share turnover). The post-acquisition abnormal return predictability increases with the relative price premium. In this light, corporate incumbents steer major corporate investment decisions to cater to the preferences of myopic investors who seek to secure short-term profits.

Baker, Pan, and Wurgler (JFE 2012) empirically find that the 52-week high stock prices serve as salient reference points for senior managers, executive directors, and other stakeholders in the M&A announcement period (Tversky and Kahneman, SCI 1974; Kahneman and Tversky, ECMT 1979). These salient reference points anchor the takeover-premium expectations of corporate incumbents of both the bidder and target firms. Bidder-firm boards can cater to the preferences of the target firm's shareholders by anchoring the M&A transaction price to the 52-week peak stock price. Ceteris paribus, a 10% increase in the 52-week high stock price correlates with a 3% increase in the takeover premium. Target-firm boards that discourage an M&A deal often emphasize that the bid is below the 52-week high stock price, whereas, target-firm boards that encourage an M&A deal note when the bid compares favorably with the 52-week high stock price. Merger waves coincide with higher recent stock returns and stock market values. The market's 52-week high stock price relative to its current value is inversely related to the number of mergers and acquisitions. The preponderance of Baker, Pan, and Wurgler's (JFE 2012) results echoes the market-timing thesis first proposed by Shleifer and Vishny (JFE 2003). These results further lend credence to the catering theory that sheds fresh light on the determination of M&A deal prices.

Baker and Wurgler (JF 2004, HEF 2012) argue that corporations often cater to investor preferences for cash dividend initiation or omission. When dividend-paying firms trade at a premium relative to non-payers, many firms are inclined to initiate cash dividend payments. When dividend-paying firms trade at a discount relative to non-payers, many firms are inclined to omit cash dividend payments. This catering theory of dividend payout predicts the initiation and omission of cash dividend payments but not their magnitude.

Becker, Ivkovic, and Weisbenner (JF 2011) further find evidence in support of local dividend clienteles. Incumbents cater to the demand for cash dividends if the firm's headquarters are in an American state where seniors constitute a large fraction of the local population. Demographic changes can have a first-order impact on corporate dividend payout decisions in response to senior investor preferences.

This analytic essay cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, personal finance tools, and other self-help inspirations. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This free ebook, AYA Analytica, shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

We hope you enjoy the substantive content of this essay! AYA!

Andy Yeh

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE) ©

Do you find it difficult to beat the long-term average 11% stock market return?

It took us 20+ years to design a new profitable algorithmic asset investment model and its attendant proprietary software technology with fintech patent protection in 2+ years. AYA fintech network platform serves as everyone's first aid for his or her personal stock investment portfolio. Our proprietary software technology allows each investor to leverage fintech intelligence and information without exorbitant time commitment. Our dynamic conditional alpha analysis boosts the typical win rate from 70% to 90%+.

Our new alpha model empowers members to be a wiser stock market investor with profitable alpha signals! The proprietary quantitative analysis applies the collective wisdom of Warren Buffett, George Soros, Carl Icahn, Mark Cuban, Tony Robbins, and Nobel Laureates in finance such as Robert Engle, Eugene Fama, Lars Hansen, Robert Lucas, Robert Merton, Edward Prescott, Thomas Sargent, William Sharpe, Robert Shiller, and Christopher Sims.

Follow our Brass Ring Facebook to learn more about the latest financial news and fantastic stock investment ideas: http://www.facebook.com/brassring2013.

Follow AYA Analytica financial health memo (FHM) podcast channel on YouTube: https://www.youtube.com/channel/UCvntmnacYyCmVyQ-c_qjyyQ

Free signup for stock signals: https://ayafintech.network

Mission on profitable signals: https://ayafintech.network/mission.php

Model technical descriptions: https://ayafintech.network/model.php

Blog on stock alpha signals: https://ayafintech.network/blog.php

Freemium base pricing plans: https://ayafintech.network/freemium.php

Signup for periodic updates: https://ayafintech.network/signup.php

Login for freemium benefits: https://ayafintech.network/login.php

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-09-17 08:33:00 Tuesday ET

Global stock market investors foresee the harbinger of a major economic downturn. Many stock market investors become anxious due to negative term spreads an

2019-10-05 07:27:00 Saturday ET

Treasury Secretary Steven Mnuchin indicates that there is a good conceptual trade agreement between China and the U.S. in regard to intellectual property pr

2021-05-20 10:30:00 Thursday ET

Artificial intelligence, 5G, and virtual reality can help transform global trade, finance, and technology. Core trade technological advances and disruptive

2017-12-19 09:39:00 Tuesday ET

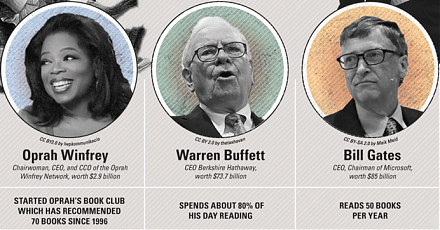

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2019-08-06 07:28:00 Tuesday ET

Former basketball star Shaq O'Neal has almost quadrupled his net worth once he learns and applies an ingenious investment strategy from Amazon Founder J

2018-05-01 11:38:00 Tuesday ET

America and China play the game of chicken over trade and technology, whereas, most market observers and economic media commentators hope the Trump team to