2018-07-23 07:41:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump now agrees to cease fire in the trade conflict with the European Union. Both sides can work together towards *zero tariffs, zero non-tariff barriers, and zero subsidies on non-automobile industrial goods*. Trade barriers in services, chemical products, and pharmaceutical medications are on the chopping block too. Pundits point out that President Trump secures direct trade talks with the European Union to negotiate a similar deal to the prior Transatlantic Trade and Investment Partnership (TTIP).

Trump agrees to hold off further tariffs, halts punitive measures and sanctions on European cars, and thus avoids escalation into a tit-for-tat trade dispute. However, many international trade experts remain skeptical of Trump's mercurial personality and his pet peeve over America's trade deficits with the European partners. The current trade truce may or may not be permanent during the Trump administration.

In addition to China and Canada, the European Union causes large bilateral trade deficits with America. U.S. farm producers of soy, corn, wheat, cotton, dairy, and pork can receive $12 billion temporary subsidies in light of Trump tariffs, quotas, and even embargoes on Europe. Whether this trade protectionism proves to be effective remains an open debate. The law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-11-24 09:30:00 Tuesday ET

Many analytic business competitors can apply smart data science to support their distinctive capabilities and strategic advantages. Thomas Davenport and

2017-12-19 09:39:00 Tuesday ET

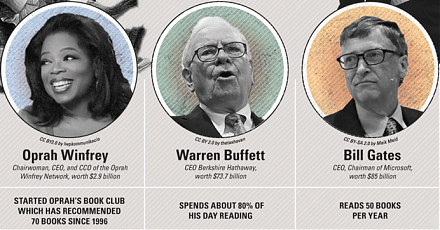

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2019-08-31 14:39:00 Saturday ET

AYA Analytica finbuzz podcast channel on YouTube August 2019 In this podcast, we discuss several topical issues as of August 2019: (1) Warren B

2020-04-03 09:28:00 Friday ET

The Intel trinity of Robert Noyce, Gordon Moore, and Andy Grove establishes the primary semiconductor tech titan in Silicon Valley. Michael Malone (2014)

2019-04-07 13:39:00 Sunday ET

CNBC news anchor Becky Quick interviews Warren Buffett in early-2019. Buffett explains the fact that book value fluctuations are a metric that has lost rele

2018-05-09 08:31:00 Wednesday ET

CBS and its special committee of independent directors have decided to sue the Redstone controlling shareholders because these directors might have breached