2017-11-03 06:41:00 Fri ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Broadcom, a one-time division of Hewlett-Packard and now a semiconductor maker whose chips help power iPhone X, has announced its strategic plans to move its legal headquarters from Singapore to America. This press conference takes place at the White House where President Trump heralds this move as an endorsement of his recent business-friendly tax overhaul reform and then names Broadcom one of the great companies worldwide. In addition, Broadcom has announced its $100 billion offer to acquire Qualcomm, another major chip-maker and upstream supplier for Apple. This strategic M&A deal would be the biggest takeover in the history of the technology industry. In the broader context of consolidation within the semiconductor industry, the Broadcom-Qualcomm empire's services would reach almost every smartphone in the world.

Although Qualcomm intends to reject this takeover bid and portrays it as cheap and opportunistic, Broadcom's close connections to the Trump administration can be viewed as a new template for savvy deal makers and tech executives to politically maneuver mergers and acquisitions under the Trump administration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-06-21 05:36:00 Wednesday ET

In his latest Berkshire Hathaway annual letter to shareholders, Warren Buffett points out that many people misunderstand his stock investment method in seve

2018-09-27 11:41:00 Thursday ET

Michael Kors pays $2.3 billion to acquire the Italian elite fashion brand Versace. In accordance with Michael Kors's 5-year plan, the joint company grow

2023-12-09 08:28:00 Saturday ET

International trade, immigration, and elite-mass conflict The elite model portrays public policy as a reflection of the interests and values of elites. I

2018-01-23 06:38:00 Tuesday ET

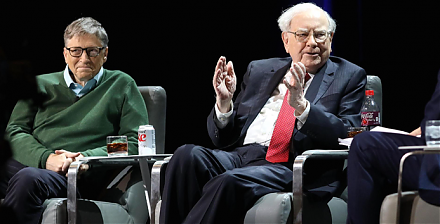

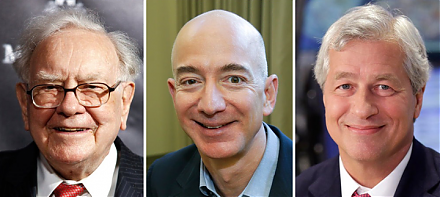

Amazon, Berkshire Hathaway, and JPMorgan Chase establish a new company to reduce U.S. employee health care costs in negotiations with drugmakers, doctors, a

2019-08-14 10:31:00 Wednesday ET

Netflix suffers its first major loss of U.S. subscribers due to the recent price hikes. The company adds only 2.7 million new subscribers in 2019Q2 in stark

2017-03-03 05:39:00 Friday ET

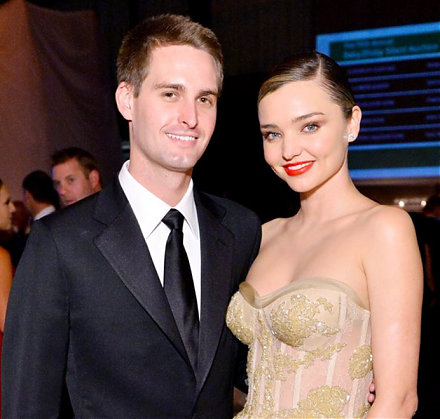

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.