2019-11-21 11:34:00 Thu ET

federal reserve monetary policy treasury dollar employment inflation interest rate exchange rate macrofinance recession systemic risk economic growth central bank fomc greenback forward guidance euro capital global financial cycle credit cycle yield curve

Berkeley macro economist Brad DeLong sees no good reasons for an imminent economic recession with mass unemployment and even depression. The current U.S. economic expansion can be sustainable over the longer run when the Trump administration helps direct people and resources from low to high-marginal-return productive activities. There is no clear sign of an economic recession with higher unemployment in light of moderate wage inflation, low price inflation below the 2% target, and reasonable real economic output. These fundamental considerations suggest that the current U.S. economic boom is likely to sustain at least over the medium term.

However, envy and greed are often the muses that almost always convince some stock market investors to buy equity stakes at the peak of an asset bubble. Later these stock market investors would wonder why there are no hints of the probable risks or black swans. The same economic rationale also applies to more generic investors who retain an active interest in bonds, currencies, futures, and precious metals such as gold, silver, and platinum etc.

As the Federal Reserve maintains the current dovish interest rate adjustments with Treasury fiscal stimulus packages such as tax cuts and infrastructure expenditures, an economic recession cannot be imminent under normal labor market conditions.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-12 10:33:00 Saturday ET

With majority control, House Democrats pass 2 bills to reopen the U.S. government without funding the Trump border wall. President Trump makes a surprise Wh

2020-06-24 09:32:00 Wednesday ET

Several business founders and entrepreneurs take low risks with high potential rewards to buck the conventional wisdom. Renee Martin and Don Martin (2010

2019-10-25 07:49:00 Friday ET

U.S. fiscal budget deficit hits $1 trillion or the highest level in 7 years. The current U.S. Treasury fiscal budget deficit rises from $779 billion to $1.0

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2017-09-19 05:34:00 Tuesday ET

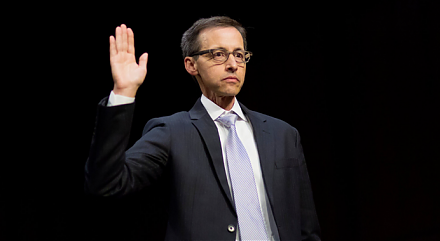

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2017-03-09 05:32:00 Thursday ET

From 1927 to 2017, the U.S. stock market has delivered a hefty average return of about 11% per annum. The U.S. average stock market return is high in stark