2017-03-15 08:46:00 Wed ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

The heuristic rule of *accumulative advantage* suggests that a small fraction of the population enjoys a large proportion of both capital and wealth creation in a given economy.

This Pareto puzzle persists and prevails in the world’s core economies such as America, Australia, China, Europe, Japan, and even Russia.

In corporate strategic management and industrial organization, a slightly better product or service often leads to dramatically better sales turnover and net profit margin over many years.

Modern examples include Apple's iPhone and iPad, Google's search engine, Microsoft's software design and development, Amazon's ecommerce platform, and Facebook's online social network.

Each of these technological advances represents the cutting-edge and one-of-a-kind proprietary innovation under U.S. patent protection.

Is it about time for us to re-assess the root cause(s) of this Pareto puzzle in the stock market (i.e. accumulative advantage versus competitive advantage in the prescient words of Professor Michael Porter)?

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-07-03 11:42:00 Tuesday ET

President Trump's current trade policies appear like the Reagan administration's protectionist trade policies back in the 1980s. In comparison to th

2019-08-30 11:35:00 Friday ET

The conventional wisdom suggests that chameleons change their skin coloration to camouflage their presence for survival through Darwinian biological evoluti

2019-10-19 16:35:00 Saturday ET

European economic integration seems to have gone backwards primarily due to the recent Brexit movement. Brexit, key European sovereign debt, and French and

2018-05-15 08:40:00 Tuesday ET

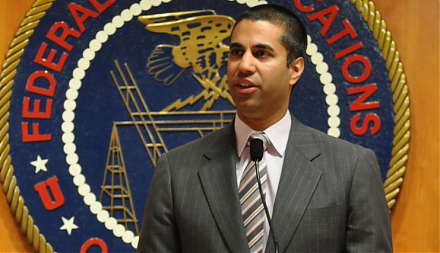

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2025-09-24 09:49:53 Wednesday ET

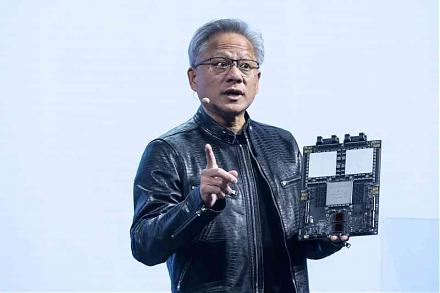

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t