2019-08-10 21:44:00 Sat ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

McKinsey Global Institute analyzes 315 U.S. cities and 3,000 counties in terms of how tech automation affects their workers in the next 5 to 10 years. This analysis finds that the zip code of primary residence may be the most important determinant of the economic future for the American middle class. The 25 U.S. mega-cities and their peripheries are home to about a third of the chief American workforce. These metropolitan areas are likely to continue to capture 60%+ of U.S. job growth in the next few years. By contrast, 54 suburban areas and 2,000 rural counties are home to only a quarter of the U.S. population, and the rural areas may suffer with virtually zero employment growth in the next decade.

In this fresh light, America is a mosaic of local economies that traverse on divergent economic trajectories. Tech automation and artificial intelligence may inadvertently widen these economic disparities. The McKinsey report further indicates that the current tech trends may displace about 12 million Hispanic and African-American workers in the next few years. The government needs to invest in higher education to build the U.S. workforce of the new century, and this public investment should focus on closer employer-educator partnerships.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-08-19 14:43:00 Saturday ET

In a recent tweet, President Donald Trump criticizes Amazon over taxes and jobs. Without providing specific evidence, Trump accuses of the e-commerce retail

2017-11-25 06:34:00 Saturday ET

Mario Draghi, President of the European Central Bank, heads the international committee of financial supervisors and has declared their landmark agreement o

2017-12-19 09:39:00 Tuesday ET

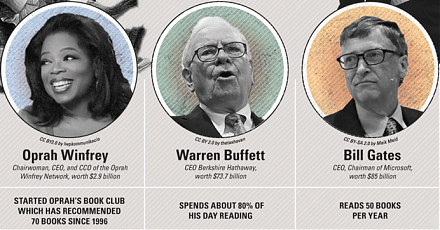

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2019-11-06 12:29:00 Wednesday ET

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Facebook, Apple, Microsoft, Google, and Amazon (F.A.

2022-08-30 10:32:00 Tuesday ET

The financial services industry needs fewer banks worldwide. As long as banks have existed in human history, their managers have realized how not all dep

2024-04-30 08:28:00 Tuesday ET

Andy Yeh Alpha (AYA) fintech network platform: major milestones, key product features, and online social media services Introduction