Search results : yield curve

2019-09-11 09:31:00 Wednesday ET

2019-09-09 20:38:00 Monday ET

2019-09-07 17:37:00 Saturday ET

2019-08-20 07:33:00 Tuesday ET

2019-08-03 09:28:00 Saturday ET

2019-08-02 17:39:00 Friday ET

2019-07-07 18:36:00 Sunday ET

2019-06-19 09:27:00 Wednesday ET

2019-06-11 12:33:00 Tuesday ET

2019-06-09 11:29:00 Sunday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2016-11-09 00:00:00 Wednesday ET

Universally dismissed as a vanity presidential candidate when he entered a field crowded with Republican talent, the former Democrat and former Independent

2018-11-11 13:42:00 Sunday ET

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears

2025-05-21 04:27:10 Wednesday ET

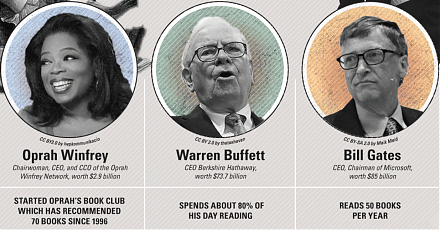

Carol Dweck describes, discusses, and delves into the scientific reasons why the growth mindset often helps motivate individuals, teams, and managers to acc

2019-11-26 11:30:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube November 2019 In this podcast, we discuss several topical issues as of November 2019: (1) The Trump adm

2018-03-21 06:32:00 Wednesday ET

Fed Chair Jerome Powell increases the neutral interest rate to a range of 1.5% to 1.75% in his debut post-FOMC press conference. The Federal Reserve raises

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (