Search results : value

2022-11-25 09:29:00 Friday ET

2022-03-05 09:27:00 Saturday ET

2020-09-15 08:38:00 Tuesday ET

2020-02-05 10:28:00 Wednesday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2021-02-01 10:19:00 Monday ET

In recent times, the International Monetary Fund (IMF) predicts that the fiscal-debt-to-GDP ratio of most rich economies would rise from 95% in 2018 to 135%

2019-12-22 08:30:00 Sunday ET

European Commission President Ursula von der Leyen now protects the European circular economy and green growth from 2020 to 2050. The new circular economy r

2024-04-02 04:45:41 Tuesday ET

Stock Synopsis: High-speed 5G broadband and mobile cloud telecommunication In the U.S. telecom industry for high-speed Internet connections and mobile cl

2019-04-30 19:46:00 Tuesday ET

AYA Analytica finbuzz podcast channel on YouTube April 2019 In this podcast, we discuss several topical issues as of April 2019: (1) Our proprietary

2018-11-19 09:38:00 Monday ET

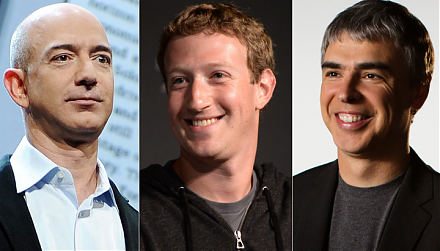

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2019-01-17 10:41:00 Thursday ET

Sino-American trade talks make positive progress over 3 consecutive days as S&P 500 and global stock market indices post 3-day win streaks. Asian and Eu