Search results : funds

2026-02-02 12:30:00 Monday ET

2025-02-02 11:28:00 Sunday ET

2024-02-04 08:28:00 Sunday ET

2023-02-03 08:27:00 Friday ET

2022-02-02 10:33:00 Wednesday ET

2021-02-02 14:24:00 Tuesday ET

2020-02-02 10:31:00 Sunday ET

2019-12-13 09:32:00 Friday ET

2019-11-26 11:30:00 Tuesday ET

2019-11-17 14:43:00 Sunday ET

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-05-14 12:35:00 Thursday ET

Disruptive innovators can better compete against luck by figuring out why customers hire products and services to accomplish jobs. Clayton Christensen, T

2025-06-13 08:23:00 Friday ET

What are the mainstream legal origins of President Trump’s new tariff policies? We delve into the mainstream legal origins of President Trump&rsquo

2018-11-19 09:38:00 Monday ET

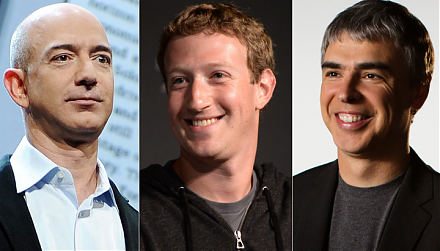

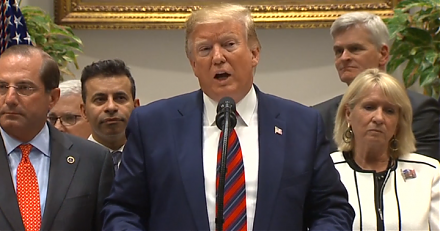

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2023-02-03 08:27:00 Friday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2023. Our proprietary alpha investment model outperforms the ma

2019-09-23 12:25:00 Monday ET

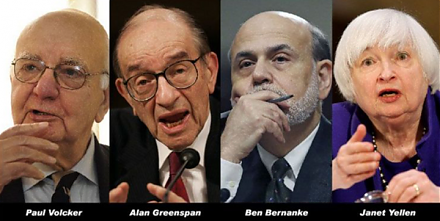

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr