2024-02-04 08:28:00 Sun ET

stock market gold oil stock return s&p 500 asset market stabilization asset price fluctuations stocks bonds currencies commodities funds term spreads credit spreads fair value spreads asset investments

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq.

We implement our proprietary alpha investment model for positive U.S. stock signals.

A complete model description is available on our AYA fintech network platform.

In a nutshell, our proprietary alpha stock investment model comprises smart-beta exposure to 6 fundamental factors such as size, value, momentum, operating profitability, asset investment, and market risk.

Our U.S. Patent and Trademark Office (USPTO) online publication is available on the World Intellectual Property Office (WIPO) official website.

Every freemium member can sign up for free to check out our proprietary alpha signals on our AYA fintech network platform.

Each freemium member can thus learn from these proprietary alpha signals over time.

The proprietary alpha investment model estimates long-term average abnormal returns for U.S. individual stocks and then ranks these stocks in accordance with their dynamic conditional alpha signals.

Several virtual members follow these dynamic conditional alpha signals to trade U.S. stocks on our AYA fintech network platform.

Many artificial intelligence developers face the black box dilemma: they remain reluctant to disclose their proprietary algorithm because they would then lose their competitive advantage.

Our competitors thus keep their proprietary algorithm in a black box.

We think outside the box, challenge the status quo, and so offer our U.S. patent publication for free. https://bit.ly/2zhN68L

Our U.S. patent publication is available on the World Intellectual Property Office (WIPO) official website: https://bit.ly/2zhN68L

We believe in the core conviction that we can carry out arduous quantitative work for the typical stock market investor who would otherwise spend too much time crunching data to generate economic insights into the fundamental prospects of U.S. individual stocks.

The proprietary alpha investment model estimates long-term average abnormal returns for U.S. individual stocks and then ranks these stocks in accordance with their dynamic conditional alpha signals.

For convenient review, we list the U.S. stock portfolio positions for these 17 virtual members and their stock portfolios on our AYA fintech network platform.

We track the stock prices and returns for the recent 6-year period from early-February 2017 to early-February 2024.

This data span allows us to conduct an out-of-sample test to assess our proprietary alpha investment model performance in comparison to the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq etc.

Dow Jones, Nasdaq, and S&P 500 yield 9.81% to 15.6% net overall returns per annum (NORPA).

MSCI stock market benchmarks deliver 1.13% to 11.75% NORPAs (MSCI USA, MSCI World, MSCI Europe, and MSCI Asia).

With our proprietary alpha investment model, all of our virtual stock portfolios outperform the S&P 500 and MSCI stock market benchmarks with 17.5% to 19.22% NORPAs (cf. the above tabular results for all net overall returns per annum (NORPAs)).

In fact, all of the 17 virtual stock portfolios deliver higher NORPAs than Dow Jones, Nasdaq, S&P 500, and all of the MSCI stock market benchmarks.

The recent double-digits model performance corroborates the scientific fact that our proprietary alpha investment model outperforms almost all of the major stock market benchmarks.

Sign up for free to learn more about our proprietary alpha signals for U.S. stocks, economic trends, investment memes, and personal finance tips.

Our free podcasts and blog posts cover the latest stock market issues.

AYA is the new Facebook for stock market investors.

Our recent research suggests that the proprietary alpha investment model captures dynamism in several fundamental factors such as size, value, momentum, asset growth, operating profitability, and market risk exposure (cf. Fama-French fundamental factors).

Also, the empirical evidence indicates substantial mutual causation between macroeconomic innovations and dynamic conditional alphas.

This causal relation serves as a core qualifying condition for fundamental factor selection in our modern asset pricing model design and performance evaluation.

In conclusion, we help demystify the pervasive misconception that it is often difficult for individual investors to beat the long-term average 11% stock market return.

Our proprietary alpha investment model outperforms the major stock market benchmarks such as S&P 500, MSCI, Dow Jones, and Nasdaq.

We implement our proprietary alpha investment model for positive U.S. stock signals.

A complete model description is available on our AYA fintech network platform.

Our U.S. Patent and Trademark Office (USPTO) patent publication is available on the World Intellectual Property Office (WIPO) website.

Every freemium member can sign up for free to check out our proprietary alpha signals on our AYA fintech network platform.

Each freemium member can thus learn from these proprietary alpha signals over time.

AYA fintech network platform serves as the social toolkit for profitable stock investment management.

AYA is the new stock market Facebook that helps promote better financial literacy, freedom, and inclusion of the global general public.

We empower investors through technology, education, and social integration.

Sign up for free to learn more about our proprietary alpha signals for U.S. stocks, economic trends, investment memes, and personal finance tips.

Our free podcasts and blog posts cover the latest stock market issues.

AYA is the new Facebook for stock market investors.

Andy Yeh

Postdoc Co-Chair

Brass Ring International Density Enterprise (BRIDE) ©

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-06 09:39:00 Wednesday ET

Donald Trump and Kim Jong Un meet, talk, and shake hands in the historic peace summit between America and North Korea in Singapore. At the start of the bila

2017-10-09 09:34:00 Monday ET

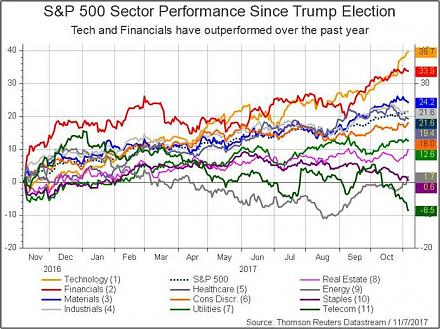

The current Trump stock market rally has been impressive from November 2016 to October 2017. S&P 500 has risen by 21.1% since the 2016 presidential elec

2018-01-04 07:36:00 Thursday ET

The world now faces an economic inequality crisis with few policy options. Some recent U.S. Federal Reserve data suggest that both income and wealth inequal

2017-12-17 11:41:00 Sunday ET

Warren Buffett points out that it is important to invest in oneself. Learning about oneself empowers him or her to lead a meaningful life. This valuable inv

2018-09-27 11:41:00 Thursday ET

Michael Kors pays $2.3 billion to acquire the Italian elite fashion brand Versace. In accordance with Michael Kors's 5-year plan, the joint company grow

2019-10-15 09:13:00 Tuesday ET

U.K. prime minister Boris Johnson encounters defeat during his new premiership. The first major vote would pave the path of least resistance to passing a no