2018-03-25 08:39:00 Sun ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

President Trump imposes punitive tariffs on $60 billion Chinese imports in a brand-new trade war as China hits back with retaliatory tariffs on $3 billion U.S. exports. This strategic move hits China for its unfair trade practices with at least 3 major jabs. First, the Trump tariffs take the form of 25% key duties on $60 billion Chinese exports to America. This jab is only a fraction of the economic collateral damage that China has done to America by forcibly extracting the intellectual properties of U.S. corporations.

Second, the Trump administration can introduce foreign investment restrictions on Chinese companies. This prevention can stop Chinese companies from swooping into U.S. competitive advantages.

Third, the Trump team considers litigation at the World Trade Organization (WTO). Since the inception of its WTO membership, China has indeed failed to transform into an open democratic society that respects both economic freedom and the rule of law.

Overall, the Trump tariffs signal the dawn of an inevitable Sino-American trade war. Trump uses the sequential tariff tactics and economic sanctions on China, Iran, and Russia and even some western allies such as Canada, Europe, and Mexico. These tactical solutions may help reduce U.S. trade and budget deficits.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-02 13:30:00 Thursday ET

Netflix has an unsustainable business model in the meantime. Netflix maintains a small premium membership fee of $9-$14 per month for its unique collection

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t

2017-12-23 10:40:00 Saturday ET

Despite having way more responsibility than anyone else, top business titans such as Warren Buffett, Charlie Munger, and Oprah Winfrey often step away from

2019-01-29 10:33:00 Tuesday ET

Global trade transforms from labor cost arbitrage to high-skill knowledge work. In fact, multinational manufacturers have been trying to create global suppl

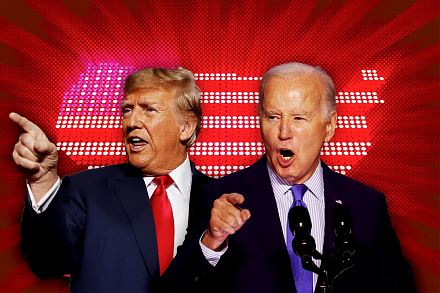

2024-03-19 03:35:58 Tuesday ET

U.S. presidential election: a re-match between Biden and Trump in November 2024 We delve into the 5 major economic themes of the U.S. presidential electi

2018-01-19 11:32:00 Friday ET

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation,