Home > Personal Investment Vitae

Location: United States

Gender: Male

Asset investment style: Quantitative technical analysis

Market capitalization:

$7,969,204talentsVirtual portfolio value:

$4,976,869talentsNet overall return per annum:

19.08%AYA current rank order:

#6Asset investment philosophy:

Peter Prince trades U.S. stocks with the top #401 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 76,537 | +681.13% | $276,299 |

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 14,872 | +2,108.33% | $112,878 |

| TEAM | Atlassian Corporation Class A Common Stock | $28.92 | $224.83 | 201 | +677.42% | $39,378 |

| SHOP | Shopify Inc. Class A Subordinate Voting Shares | $56.05 | $426.82 | 104 | +661.50% | $38,560 |

| AXSM | Axsome Therapeutics Inc. Common Stock | $4.60 | $31.75 | 1,267 | +590.22% | $34,399 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 836 | +589.24% | $34,335 |

| SQ | Block Inc. Class A Common Stock | $14.50 | $99.54 | 402 | +586.48% | $34,186 |

| FIVN | Five9 Inc. Common Stock | $16.31 | $110.10 | 357 | +575.05% | $33,483 |

| TRNS | Transcat Inc. Common Stock | $11.35 | $73.00 | 513 | +543.17% | $31,626 |

| GLOB | Globant S.A. Common Shares | $34.57 | $215.99 | 168 | +524.79% | $30,479 |

| Sum | $665,623 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| TRVI | Trevi Therapeutics Inc. Common Stock | $13.30 | 3,562 | $47,374 |

| TREE | LendingTree Inc. Common Stock | $42.90 | 1,098 | $47,104 |

| PLTR | Palantir Technologies Inc. Class A Common Stock | $157.16 | 299 | $46,990 |

| WDAY | Workday, Inc. | $151.04 | 306 | $46,218 |

| ZETA | Zeta Global Holdings Corp. Class A Common Stock | $18.84 | 2,421 | $45,611 |

| MHH | Mastech Digital Inc Common Stock | $6.66 | 6,828 | $45,474 |

| PAYC | Paycom Software Inc. Common Stock | $138.01 | 326 | $44,991 |

| VAC | Marriott Vacations Worldwide Corporation Common Stock | $70.50 | 631 | $44,485 |

| HIMS | Hims & Hers Health Inc. Class A Common Stock | $15.74 | 2,826 | $44,481 |

| IT | Gartner Inc. Common Stock | $169.00 | 261 | $44,109 |

| Sum | $456,837 |

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @alin | |||

| @Chanel Holden | |||

| @Andy Yeh Alpha | |||

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

2020-08-26 10:33:00 Wednesday ET

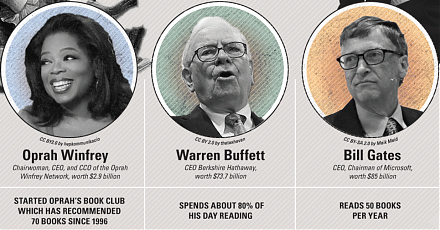

Through purposeful leadership, senior managers inspire teams to reach heights of both innovation and profitability with great brand identity and customer lo

2020-07-26 15:29:00 Sunday ET

Firms and customers create value and wealth together by joining the continual flow of small batches of lean production to the lean consumption of cost-effec

2019-08-03 09:28:00 Saturday ET

U.S. inflation has become sustainably less than the 2% policy target in recent years. As Harvard macro economist Robert Barro indicates, U.S. inflation has

2019-04-30 07:15:00 Tuesday ET

Through our AYA fintech network platform, we share numerous insightful posts on personal finance, stock investment, and wealth management. Our AYA finte

2019-05-23 10:33:00 Thursday ET

Berkeley professor and economist Barry Eichengreen reconciles the nominal and real interest rates to argue in favor of greater fiscal deficits. French econo

2018-09-17 12:40:00 Monday ET

Nobel Laureate Robert Shiller's long-term stock market indicator points to a recent peak. His cyclically-adjusted P/E ratio (or CAPE) accounts for long-