2018-06-29 11:41:00 Fri ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Amazon acquires an Internet pharmacy PillPack in order to better compete with Walgreens Boots Alliance, CVS Health, Rite Aid, and many other drug distributors. CVS Health, Rite Aid, and Walgreens Boots Alliance shares plunge 6%-10% in response to Amazon's expansion into the online pharmacy business. Through this strategic move, Amazon shakes up the online medicine business with its ambitious $1 billion acquisition of Internet retail pharmacy PillPack. This disruptive innovation changes the competitive landscape for traditional pharmacies.

PillPack organizes, packages, and delivers drugs online. This Internet pharmacy delivers consumers medical packages and also prescription drugs with the specific number of medications that consumers need to take at particular times. Amazon CEO Jeff Bezos continues to focus on the long-term persistent trends that are less likely to change in the next few decades. In one of his earlier key letters to Amazon shareholders, Bezos emphasizes the fact that the vast majority of consumers want to enjoy cost-effective online retail solutions to their daily problems with both fast delivery and vast selection. The recent acquisition of PillPack allows Amazon to tap into the uncharted territory of Internet pharmacy as the tech titan continues to uphold the Bezos tripartite principle (i.e. low cost, fast delivery, and vast selection).

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

2018-04-26 07:37:00 Thursday ET

Credit supply growth drives business cycle fluctuations and often sows the seeds of their own subsequent destruction. The global financial crisis from 2008

2020-03-19 13:39:00 Thursday ET

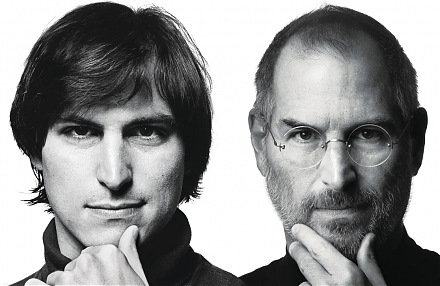

The business legacy and sensitivity of Steve Jobs can transform smart mobile devices with Internet connectivity, music and video content curation, and digit

2024-04-30 08:28:00 Tuesday ET

Andy Yeh Alpha (AYA) fintech network platform: major milestones, key product features, and online social media services Introduction

2019-06-25 10:34:00 Tuesday ET

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the a

2018-12-19 17:41:00 Wednesday ET

Tencent Music Entertainment debuts its IPO on NYSE to strike a chord with stock market investors. Tencent Music goes public and marks the biggest IPO by a m