Home > Personal Investment Vitae

Location: United States

Gender: Female

Asset investment style: Hybrid analysis

Market capitalization:

$7,582,698talentsVirtual portfolio value:

$4,623,037talentsNet overall return per annum:

18.11%AYA current rank order:

#14Asset investment philosophy:

Olivia London trades U.S. stocks with the top #176 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 21,280 | +2,108.33% | $161,515 |

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 44,545 | +681.13% | $160,807 |

| BQ | Boqii Holding Limited American Depositary Shares representing Class A Ordinary Shares | $0.36 | $3.36 | 47,977 | +833.33% | $143,931 |

| BQ | Boqii Holding Limited Class A Ordinary Shares | $0.36 | $3.36 | 47,977 | +833.33% | $143,931 |

| XBIOW | Xenetic Biosciences Inc. Warrants | $2.00 | $23.16 | 5,273 | +1,058.00% | $111,577 |

| LGVN | Longeveron Inc. Class A Common Stock | $3.45 | $26.25 | 3,044 | +660.87% | $69,403 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 1,078 | +589.24% | $44,273 |

| FIVN | Five9 Inc. Common Stock | $16.31 | $110.10 | 460 | +575.05% | $43,143 |

| GLOB | Globant S.A. Common Shares | $34.57 | $215.99 | 217 | +524.79% | $39,368 |

| HZNP | Horizon Therapeutics Public Limited Company Ordinary Shares | $16.41 | $98.56 | 458 | +500.61% | $37,625 |

| Sum | $955,573 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| HIMS | Hims & Hers Health Inc. Class A Common Stock | $23.84 | 1,375 | $32,780 |

| IMMX | Immix Biopharma Inc. Common Stock | $10.11 | 2,474 | $25,012 |

| DDD | 3D Systems Corporation Common Stock | $2.39 | 10,348 | $24,731 |

| NET | Cloudflare Inc. Class A Common Stock | $212.11 | 115 | $24,392 |

| CNR | Core Natural Resources Inc. Common Stock | $100.04 | 243 | $24,309 |

| STKE | Sol Strategies Inc. Common Shares | $1.55 | 15,603 | $24,184 |

| CRWD | CrowdStrike Holdings Inc. Class A Common Stock | $441.54 | 53 | $23,401 |

| AMR | Alpha Metallurgical Resources Inc. Common Stock | $189.48 | 122 | $23,116 |

| ESCA | Escalade Incorporated Common Stock | $16.57 | 1,387 | $22,982 |

| VLO | Valero Energy Corporation Common Stock | $235.81 | 97 | $22,873 |

| Sum | $247,780 |

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Andy Yeh Alpha | |||

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

2020-01-15 08:31:00 Wednesday ET

Anti-competitive corporate practices may stifle U.S. innovation. In recent decades, wage growth, economic output, and productivity tend to stagnate as U.S.

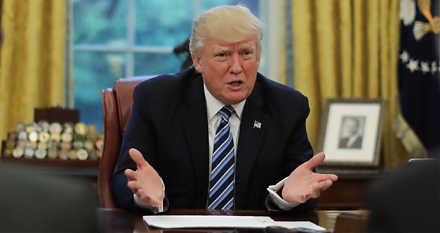

2017-07-01 08:40:00 Saturday ET

The Economist interviews President Donald Trump and spots the keyword *reciprocity* in many aspects of Trumponomics from trade and taxation to infrastructur

2026-01-31 10:31:00 Saturday ET

In recent years, several central banks conduct, assess, and discuss the core lessons, rules, and challenges from their monetary policy framework r

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2018-11-01 08:36:00 Thursday ET

Ford and Baidu team up to test autonomous cars in China. For the next few years, Ford and Baidu plan to collaborate on the car design and user acceptance te

2019-10-11 13:40:00 Friday ET

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era.