2017-07-01 08:40:00 Sat ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

The Economist interviews President Donald Trump and spots the keyword *reciprocity* in many aspects of Trumponomics from trade and taxation to infrastructure and financial deregulation.

The New Keynesian expression of *priming the pump* can lead to greater economic growth with some fiscal deficit at least in the short run. According to Treasury Secretary Steve Mnuchin, this additional economic growth can raise at least $2 trillion in tax revenue over the next decade. Also, the indefinite Trump tax holiday serves as a clear incentive for U.S. multinational corporations to repatriate offshore cash from tax havens up to $350 billion per year to invest in American job creation, manufacturing automation, technological innovation, and superior service provision.

In contrast to the core crux of Glass-Steagall Act, Trump and Mnuchin cannot envision breaking up the big banks that currently enjoy expansive economies of scale and scope. Post-Dodd-Frank deregulation provides an opportunity for bank stocks to outperform relative to the long-term average stock market P/E ratio of 15x to 16x.

While tax cuts trump trade, these tidal traces of Trumponomics shine fresh light on the new supply-side U.S. macroeconomic policy agenda in the Republican administration.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-05-17 15:24:00 Friday ET

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an

2019-05-15 12:32:00 Wednesday ET

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administ

2019-11-03 12:30:00 Sunday ET

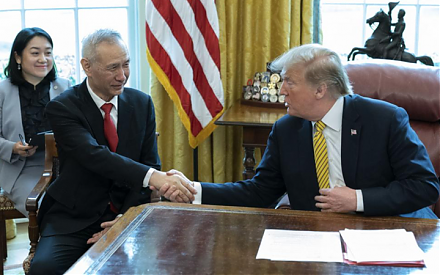

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (

2018-11-17 09:33:00 Saturday ET

Zillow share price plunges 20% year-to-date as its competitors Redfin and Trulia also experience an economic slowdown in the real estate market. The real es

2018-11-11 13:42:00 Sunday ET

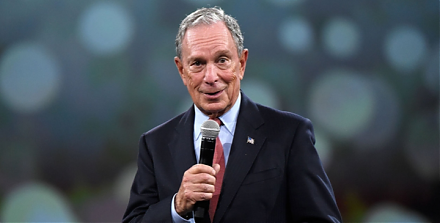

Michael Bloomberg provides $80 million as campaign finance for Democrats to flip the House of Representatives in the November 2018 midterm elections, gears