Home > Personal Investment Vitae

Location: United States

Gender: Female

Asset investment style: Quantitative fundamental analysis

Market capitalization:

$7,853,661talentsVirtual portfolio value:

$4,885,476talentsNet overall return per annum:

18.82%AYA current rank order:

#4Asset investment philosophy:

Monica McNeil trades U.S. stocks with the top #126 to #500 positive alpha signals.

Top 10 profitable stock transactions since January 2020Strategy

| Symbol | Company | Buy | Sell | Share Volume | Return (%) | Profit ($) |

|---|---|---|---|---|---|---|

| HAO | Haoxi Health Technology Limited Class A Ordinary Shares | $0.15 | $2.50 | 90,600 | +1,566.67% | $212,910 |

| RMBL | RumbleOn Inc. Class B Common Stock | $0.36 | $7.95 | 27,508 | +2,108.33% | $208,786 |

| XBIOW | Xenetic Biosciences Inc. Warrants | $2.00 | $23.16 | 5,633 | +1,058.00% | $119,194 |

| BQ | Boqii Holding Limited American Depositary Shares representing Class A Ordinary Shares | $0.36 | $3.36 | 37,750 | +833.33% | $113,250 |

| BQ | Boqii Holding Limited Class A Ordinary Shares | $0.36 | $3.36 | 37,750 | +833.33% | $113,250 |

| SXTP | 60 Degrees Pharmaceuticals Inc. Common Stock | $0.15 | $1.34 | 84,713 | +793.33% | $100,808 |

| VATE | INNOVATE Corp. Common Stock | $0.53 | $4.14 | 23,975 | +681.13% | $86,550 |

| LGVN | Longeveron Inc. Class A Common Stock | $3.45 | $26.25 | 2,672 | +660.87% | $60,922 |

| LSCC | Lattice Semiconductor Corporation Common Stock | $6.97 | $48.04 | 1,251 | +589.24% | $51,379 |

| GLOB | Globant S.A. Common Shares | $34.57 | $215.99 | 252 | +524.79% | $45,718 |

| Sum | $1,112,767 |

Top 10 current stock portfolio positions as of March 2026Strategy

| Symbol | Company | Price | Position | Capitalization |

|---|---|---|---|---|

| CNR | Core Natural Resources Inc. Common Stock | $100.04 | 1,006 | $100,640 |

| ETON | Eton Pharmaceuticals Inc. Common Stock | $19.02 | 4,862 | $92,475 |

| PLTR | Palantir Technologies Inc. Class A Common Stock | $153.50 | 602 | $92,407 |

| MHH | Mastech Digital Inc Common Stock | $6.50 | 13,746 | $89,349 |

| FTNT | Fortinet Inc. Common Stock | $84.40 | 1,045 | $88,198 |

| ZETA | Zeta Global Holdings Corp. Class A Common Stock | $18.05 | 4,874 | $87,975 |

| WTRG | Essential Utilities Inc. Common Stock | $41.06 | 2,066 | $84,829 |

| IT | Gartner Inc. Common Stock | $160.59 | 525 | $84,309 |

| VAC | Marriott Vacations Worldwide Corporation Common Stock | $66.06 | 1,270 | $83,896 |

| AUPH | Aurinia Pharmaceuticals Inc Ordinary Shares | $14.37 | 5,830 | $83,777 |

| Sum | $887,855 |

Top 20 investors

Top 20 influencers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Andy Yeh Alpha | |||

Top 20 followers

| #1 - #5 | #6 - #10 | #11 - #15 | #15 - #20 |

|---|---|---|---|

| @Bob Hessonwitz | @Vincent Bonsai | @Jack hsu | @Apple |

| @Will | @Darren | @AJ Yeh | @ZimboDave |

| @Luminoalgo | @Sandra Martinazzison | @MRCASH1991 | @Bloom789 |

| @Duke | @Mo | @Amy | @Andy Cheung |

| @TechBull22 | @Ru-Ting Yeh | @Syl_will | @George |

2019-05-15 12:32:00 Wednesday ET

The May administration needs to seek a fresh fallback option for Halloween Brexit. After the House of Commons rejects Brexit proposals from the May administ

2018-03-29 14:28:00 Thursday ET

Share prices tumble for technology stocks due to Trump's criticism of Amazon's tax avoidance, Facebook user data breach of trust, and Tesla autopilo

2017-11-27 07:39:00 Monday ET

Is it anti-competitive and illegal for passive indexers and mutual funds to place large stock bets in specific industries with high market concentration? Ha

2018-08-13 12:39:00 Monday ET

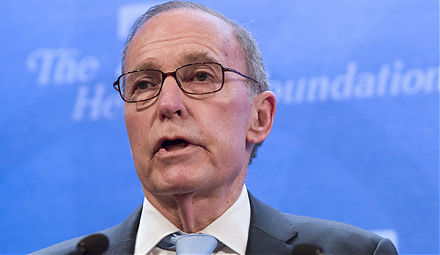

White House chief economic adviser Larry Kudlow points out that the recent U.S. dollar strength shows a clear sign of investor confidence and optimism. Gree

2019-01-23 11:32:00 Wednesday ET

Higher public debt levels, global interest rate hikes, and subpar Chinese economic growth rates are the major risks to the world economy from 2019 to 2020.

2025-10-07 10:30:00 Tuesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund