Visa Inc. operates as a payments technology company all over the world. It provides transaction processing services (primarily authorization, clearing and settlement) to financial institutions and merchant clients through VisaNet, its global processing platform. It offers a wide range of Visa-branded payment products, which its financial institution clients would develop and offer core business solutions, credit, debit, prepaid and cash access programs for account holders (individuals, businesses and government entities). Visa provides other value-added services to its clients including fraud and risk management, debit issuer processing, loyalty services, dispute management, digital services like tokenization as well as consulting and analytics. It manages and promotes its brands to the benefit of its clients and partners through advertising, promotional and sponsorship initiatives with the Olympic Games, FIFA and the National Football League among others....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-06-27 10:39:00 Thursday ET

Berkeley tax economists Gabriel Zucman and Emmanuel Saez find fresh insights into wealth inequality in America. Their latest estimates show that the top 0.1

2018-11-09 11:35:00 Friday ET

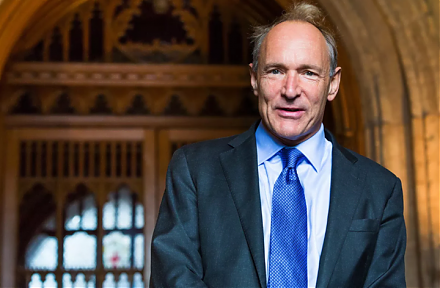

The Internet inventor Tim Berners-Lee suggests that several tech titans might need to be split up in response to some recent data breach and privacy concern

2025-09-18 08:03:32 Thursday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2019-08-16 17:37:00 Friday ET

Amazon faces E.U. antitrust scrutiny over the current e-commerce use of merchant data. The European Commission probes into whether Amazon uses key third-par

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

2018-07-30 11:36:00 Monday ET

Trumpism may now become the new populist world order of economic governance. Populist support contributes to Trump's 2016 presidential election victory