2018-06-01 07:30:00 Fri ET

treasury deficit debt employment inflation interest rate macrofinance fiscal stimulus economic growth fiscal budget public finance treasury bond treasury yield sovereign debt sovereign wealth fund tax cuts government expenditures

The U.S. federal government debt has risen from less than 40% of total GDP about a decade ago to 78% as of May 2018. The Congressional Budget Office predicts that this ratio will surge to 96% in 2028. Although many blame the Trump tax cuts as the key root cause, the increases in health care and retirement benefits suggest a different real reason for U.S. deficit severity.

Harvard professor Martin Feldstein attributes the recent rise of U.S. budget deficit from 4% to 5% of total GDP to increases in Medicare and social security retirement benefits for middle-class older Americans. These increases in core health care and retirement benefits account for about 2.7% of total GDP. The neoclassical Sargent-Wallace thesis suggests that the central bank cannot finance incessant increases in core deficits with government bond issuance regardless of money supply growth. This money supply expansion would lead to inexorable inflationary pressures that defeat the dual mandate of both maximum employment and price stability in the suboptimal fiscal-monetary policy coordination. Inflation serves as a seigniorage tax that would in turn dampen real macroeconomic variates such as household consumption, capital investment, labor supply, and total economic output. In light of this ripple effect on sustainable financial market growth and prosperity, the law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2025-01-22 08:35:08 Wednesday ET

President Donald Trump blames China for the long prevalent U.S. trade deficits and several other social and economic deficiencies. In recent years, Pres

2018-06-25 12:43:00 Monday ET

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung

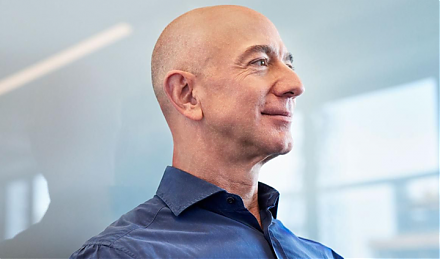

2018-06-29 11:41:00 Friday ET

Amazon acquires an Internet pharmacy PillPack in order to better compete with Walgreens Boots Alliance, CVS Health, Rite Aid, and many other drug distributo

2019-11-09 16:38:00 Saturday ET

Federal Reserve Chairman Jerome Powell indicates that the central bank would resume Treasury purchases to avoid turmoil in money markets. Powell indicates t

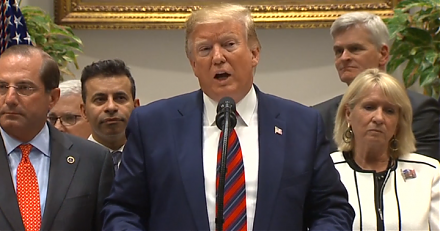

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President

2019-05-11 10:28:00 Saturday ET

The Trump administration still expects to reach a Sino-U.S. trade agreement with a better mechanism for intellectual property protection and enforcement. Pr