Stellantis N.V. is an automakers and a mobility provider. Stellantis N.V., formerly known as Fiat Chrysler Automobiles N.V., is based in LIJNDEN, Netherlands....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-05-06 07:30:00 Sunday ET

President Trump withdraws America from the Iran nuclear agreement and revives economic sanctions on Iran for better negotiations as western allies Britain,

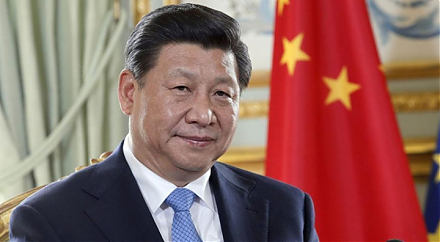

2018-03-03 11:37:00 Saturday ET

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

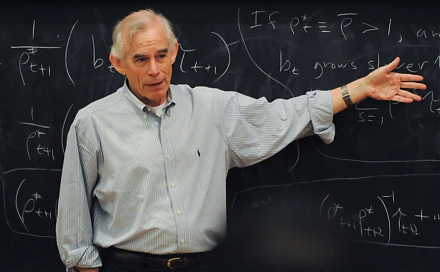

2019-03-07 12:39:00 Thursday ET

A physicist derives a mathematical formula that success equates the product of both personal quality and the potential value of a random idea. As a Northeas

2023-07-14 10:32:00 Friday ET

Ray Fair applies his macroeconometric model to study the central features of the U.S. macroeconomy such as price stability and full employment in the dual m

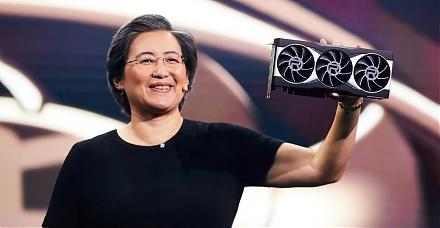

2025-10-08 11:34:00 Wednesday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2023-06-28 09:29:00 Wednesday ET

Carmen Reinhart and Kenneth Rogoff delve into several centuries of cross-country crisis data to find the key root causes of financial crises for asset marke