2018-05-17 07:41:00 Thu ET

technology social safety nets education infrastructure health insurance health care medical care medication vaccine social security pension deposit insurance

Has America become a democratic free land of crumbling infrastructure, galloping income inequality, bitter political polarization, and dysfunctional governance? Key measures of American public engagement, satisfaction, and confidence are near historic low rates. These measures encompass voter turnout, general knowledge of socioeconomic public policy issues, and individual respect for basic government institutions.

U.S. infrastructure needs a comprehensive upgrade as income inequality soars in America. After some adjustment for U.S. CPI core inflation, the middle-class wages have been nearly frozen over the past 4 decades in America, whereas, the top 1% upper-class income triples over the same time frame.

Family stock ownership concentration also exacerbates U.S. economic inequality in comparison to OECD standards. The government bails out banks and millions of Americans lose their homes and jobs in the recent decade during the subprime mortgage crisis from 2008 to 2009.

The gradual economic recovery produces pecuniary fruits exclusively for the rich. In stark contrast, the bottom 99% population experiences an income uptick of less than half of 1%. Only the American democracy that discards its major mission of holding the social community together would produce these inadvertent results and consequences.

In a positive light, however, there are more socioeconomic opportunities available nowadays for women, non-whites, and other minorities. Technological advances and miracles happen in U.S. labs, world-class universities, and tech startups that specialize in robotic automation, medical diagnosis and treatment, data analysis and visualization, or artificial intelligence.

Despite this positive progress, the U.S. meritocratic class continues to master the old trick of passing socioeconomic advantages and privileges from one generation to the next. The resultant hereditary elite income and wealth concentration harms social mobility to the harsh detriment of many minorities and immigrants in America. Greater social mobility requires a reasonable reversal of fortune via progressive capital taxation, inclusive education, universal healthcare, ubiquitous employment, social security, and less crony capitalism (such as family ownership concentration).

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2018-10-27 09:34:00 Saturday ET

U.S. automobile and real estate sales decline despite higher consumer confidence and low unemployment as of October 2018. This slowdown arises from the curr

2019-10-03 17:39:00 Thursday ET

President Trump indicates that he would consider an interim Sino-American trade deal in lieu of a full trade agreement. The Trump administration defers high

2016-10-19 00:00:00 Wednesday ET

India's equivalent to Warren Buffett in America, Rakesh Jhunjhunwala, offers several key lessons for stock market investors: When the press o

2019-03-17 14:35:00 Sunday ET

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2017-04-25 06:35:00 Tuesday ET

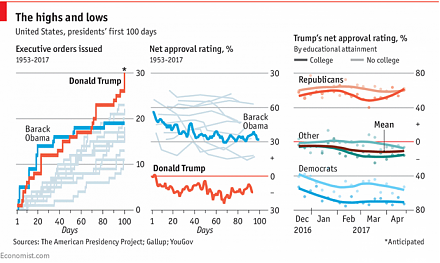

This nice and clear infographic visualization helps us better decipher the main memes and themes of President Donald Trump's first 100 days in office.

2019-07-05 09:32:00 Friday ET

Warwick macroeconomic expert Roger Farmer proposes paying for social welfare programs with no tax hikes. The U.S. government pension and Medicare liabilitie