Comstock Resources, Inc. is an independent energy company engaged in the acquisition, development, production and exploration of oil and natural gas properties. The company's oil and natural gas reserve base is entirely concentrated in the Gulf of Mexico, Southeast Texas and East Texas/North Louisiana regions....

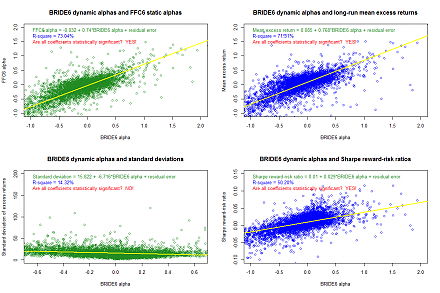

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-01-11 09:26:00 Wednesday ET

Addendum on USPTO fintech patent protection and accreditation As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S

2024-05-27 03:23:34 Monday ET

Stock Synopsis: Life insurers emphasize profit margins over sales growth rates. We review and analyze the recent market share data in the U.S. life insur

2022-09-15 11:38:00 Thursday ET

Capital structure choices for private firms The Kauffman Firm Survey (KFS) database provides comprehensive panel data on 5,000+ American private firms fr

2018-04-20 10:38:00 Friday ET

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thou

2019-04-21 10:07:54 Sunday ET

Central bank independence remains important for core inflation containment in the current age of political populism. In accordance with the dual mandate of

2020-02-26 09:30:00 Wednesday ET

Goldman Sachs follows the timeless business principles and best practices in financial market design and investment management. William Cohan (2011) M