Curis, Inc. is a therapeutic drug development company focusing on cancer, neurological and dermatological disease indications, with technologies that utilize regulatory pathways that control repair and regeneration. Curis' product development involves the use of small molecules or proteins to modulate these pathways. The company has successfully used this technology and product development approach to produce several promising drug product candidates in the fields of cancer, neurological disorders, hair growth, kidney and other diseases, as well as cardiovascular disease....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-08-13 12:39:00 Monday ET

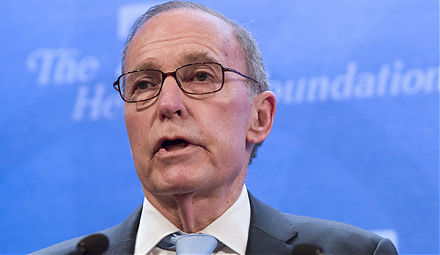

White House chief economic adviser Larry Kudlow points out that the recent U.S. dollar strength shows a clear sign of investor confidence and optimism. Gree

2017-11-13 07:42:00 Monday ET

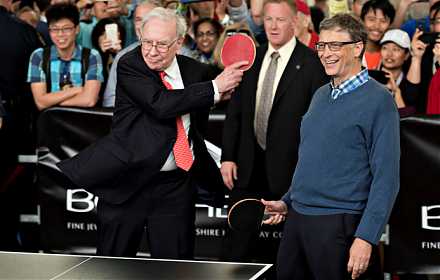

Top 2 wealthiest men Bill Gates and Warren Buffett shared their best business decisions in a 1998 panel discussion with students at the University of Washin

2025-08-09 11:31:00 Saturday ET

Wharton e-commerce entrepreneurship professor Dr Karl Ulrich explains that many top-notch universities now provide massive open online courses (MOOCs) for m

2018-11-27 10:37:00 Tuesday ET

Warren Buffett offloads a few stocks from the Berkshire Hathaway portfolio in mid-November 2018. The latest S.E.C. report shows that the Oracle of Omaha sol

2023-07-21 10:30:00 Friday ET

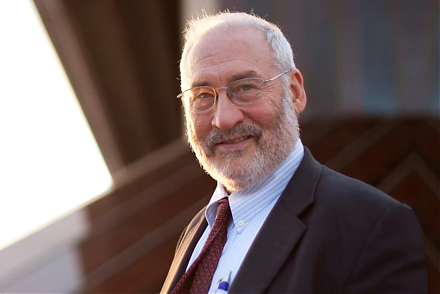

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2018-07-19 18:38:00 Thursday ET

Goldman Sachs chief economist Jan Hatzius proposes designing a new Financial Conditions Index (FCI) to be a weighted-average of interest rates, exchange rat