Corcept is focused on the discovery, development and commercialization of drugs for the treatment of severe metabolic, psychiatric and oncology disorders which are associated with the activity of the hormone cortisol, also known as the stress hormone. Corcept's only marketed drug, Korlym (mifepristone), is approved for the once-daily oral treatment of hyperglycemia secondary to hypercortisolism in adult patients with endogenous Cushing's syndrome, suffering from type II diabetes or glucose intolerance and who have failed surgery or are not suitable for surgery....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-10-09 16:46:00 Wednesday ET

IMF chief economist Gita Gopinath indicates that competitive currency devaluation may be an ineffective solution to improving export prospects. In the form

2017-03-21 09:37:00 Tuesday ET

Trump and Xi meet in the most important summit on earth this year. Trump has promised to retaliate against China's currency misalignment, steel trade

2018-11-19 09:38:00 Monday ET

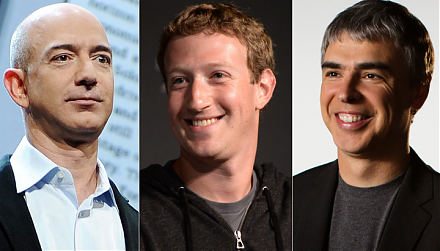

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

2018-01-12 07:37:00 Friday ET

The Economist delves into the modern perils of tech titans such as Apple, Amazon, Facebook, and Google. These key tech titans often receive plaudits for mak

2019-06-27 10:39:00 Thursday ET

Berkeley tax economists Gabriel Zucman and Emmanuel Saez find fresh insights into wealth inequality in America. Their latest estimates show that the top 0.1

2017-12-03 08:37:00 Sunday ET

Sean Parker, Napster founder and a former investor in Facebook, has become a "conscientious objector" on Facebook. Parker says Facebook explo