Sharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-06-08 13:35:00 Friday ET

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inf

2018-04-11 09:37:00 Wednesday ET

North Korean leader and president Kim Jong-Un seeks peaceful resolution and denuclearization on the Korean Peninsula. When *peace* comes to shove, Asia

2018-11-07 08:30:00 Wednesday ET

PwC releases a new study of top innovators worldwide as of November 2018. This study assesses the top 1,000 global companies that spend the most on R&D

2019-03-07 12:39:00 Thursday ET

A physicist derives a mathematical formula that success equates the product of both personal quality and the potential value of a random idea. As a Northeas

2018-10-03 11:37:00 Wednesday ET

Fed Chair Jerome Powell sees a remarkably positive outlook for the U.S. economy right after the recent interest rate hike as of September 2018. He humbly su

2018-06-25 12:43:00 Monday ET

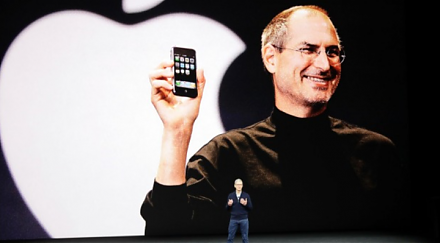

Apple and Samsung are the archrivals for the title of the world's top smart phone maker. The recent patent lawsuit settlement between Apple and Samsung