2017-11-19 08:37:00 Sun ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

In 2000, a former law professor at Harvard proposed establishing the Financial Product Safety Commission in order to protect consumer rights in the provision of financial products and services. A decade later, that law professor, Elizabeth Warren, witnessed the congressional approval of the 2010 Dodd-Frank Act and the resultant new regulatory agency, the Consumer Financial Protection Bureau, which aims to restore trust in financial institutions with 5 major pillars of financial regulation: capital adequacy rules, leverage limitations, liquidity requirements, macroprudential stress tests, and deposit insurance constraints.

"It is impossible to buy a toaster that has a 1-in-5 chance of bursting into flames and burning down a house, but it is possible to refinance a current home with a mortgage that has the same 1-in-5 chance of putting the family out on the street," Warren wrote in the first paragraph in her influential Democracy article. Maybe a toaster or a financial product or service is so defective that consumers should not be thrown back on themselves to avoid it. Conversely, consumers with more confidence in financial products or services are more likely to purchase them.

These paternalistic considerations offer insights into the Trump administration's plan to dismantle much of the Dodd-Frank Act, especially the bank capital rules and stress tests. The law of inadvertent consequences counsels caution.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-04-15 08:37:00 Monday ET

Chinese Belt-and-Road funds large international infrastructure investment projects primarily in East Asia, Central Asia, North Africa, and Italy. Chinese Be

2018-01-10 08:40:00 Wednesday ET

President Trump considers imposing retaliatory economic sanctions on Chinese products and services in direct response to China's theft and infringement

2019-11-15 13:34:00 Friday ET

The Economist offers a special report that the new normal state of economic affairs shines fresh light on the division of labor between central banks and go

2018-03-03 11:37:00 Saturday ET

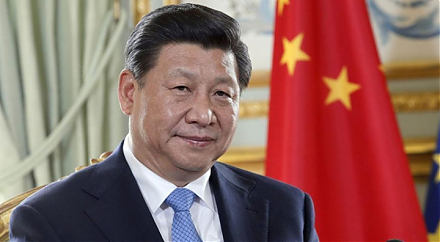

President Xi seeks Chinese congressional approval and constitutional amendment for abolishing his term limits of strongman rule with more favorable trade de

2017-09-19 05:34:00 Tuesday ET

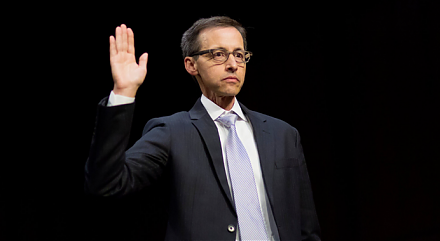

Facebook, Twitter, and Google executives head before the Senate Judiciary Committee to explain the scope of Russian interference in the U.S. presidential el

2019-01-06 08:39:00 Sunday ET

President Trump signs an executive order to freeze federal employee pay in early-2019. Federal employees face furlough or work without pay due to the govern