Sharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-12-03 11:33:00 Sunday ET

Macro innovations and asset alphas show significant mutual causation. April 2023 This brief article draws from the recent research publicati

2022-05-30 09:32:00 Monday ET

The new semiconductor microchip demand-supply imbalance remains quite severe for the U.S. tech and auto industries. Our current fundamental macro a

2020-01-08 08:25:00 Wednesday ET

Conservative Party wins the British parliamentary majority in the general election with hefty British pound appreciation. In response to this general electi

2017-01-23 09:30:00 Monday ET

There are several highlights from the first news conference after Trump's presidential election victory: The Trump administration will repeal-and-

2017-03-03 05:39:00 Friday ET

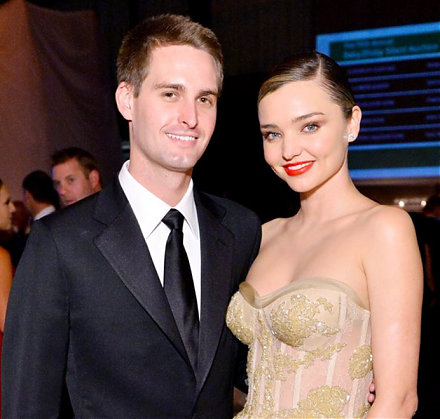

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2019-10-19 16:35:00 Saturday ET

European economic integration seems to have gone backwards primarily due to the recent Brexit movement. Brexit, key European sovereign debt, and French and