Banco Santiago is the largest bank in Chile, in terms of assets with Ch$4,088 billion (approximately US$9.86 billion ) as of March 31, 1997. The bank is the result of the merger of two of the largest institutions in the Chilean banking system, Banco O'Higgins S.A., mainly a corporate bank, and Banco de Santiago S.A., mainly focused in consumer and middle-market lending....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2026-02-02 12:30:00 Monday ET

With U.S. fintech patent approval, accreditation, and protection for 20 years, our proprietary alpha investment model outperforms most stock market indexes

2018-01-19 11:32:00 Friday ET

Most major economies grow with great synchronicity several years after the global financial crisis. These economies experience high stock market valuation,

2018-03-23 08:26:00 Friday ET

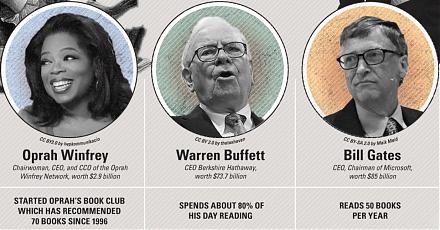

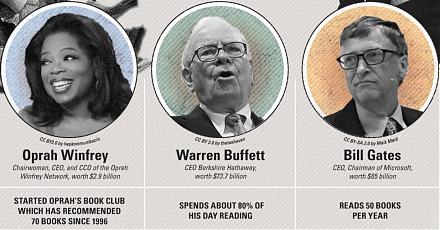

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the dai

2023-08-28 08:26:00 Monday ET

Jared Diamond delves into how some societies fail, succeed, and revive in global human history. Jared Diamond (2004) Collapse: how societies

2022-02-02 10:33:00 Wednesday ET

Our proprietary alpha investment model outperforms most stock market indices from 2017 to 2022. As of early-January 2023, the U.S. Patent and Trademark O

2019-09-23 12:25:00 Monday ET

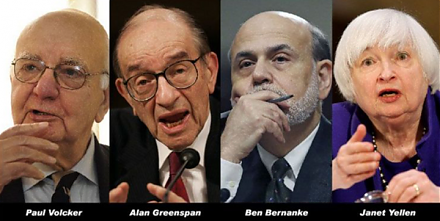

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit