The Buckle, Inc. is a leading retailer of medium to better-priced casual apparel, footwear, and accessories for fashion-conscious young men and women. Buckle markets a wide selection of brand names and private label casual apparel, including denims, other casual bottoms, tops, sportswear, outerwear, accessories and footwear. The Company emphasizes personalized attention to its guests (customers) and provides individual customer services such as free alterations, layaways, and a frequent shopper program....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2022-09-15 11:38:00 Thursday ET

Capital structure choices for private firms The Kauffman Firm Survey (KFS) database provides comprehensive panel data on 5,000+ American private firms fr

2025-04-30 08:27:00 Wednesday ET

The multiple layers of the world cloud Internet help expand what can be made digitally viable from electric vehicles (EV) and virtual reality (VR) headsets

2023-06-19 10:31:00 Monday ET

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2019-07-29 11:33:00 Monday ET

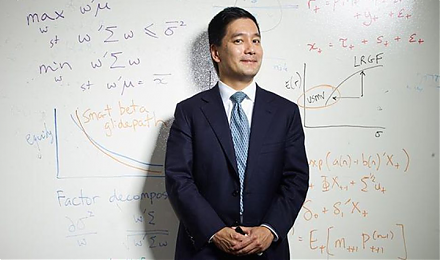

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in an inter

2019-11-03 12:30:00 Sunday ET

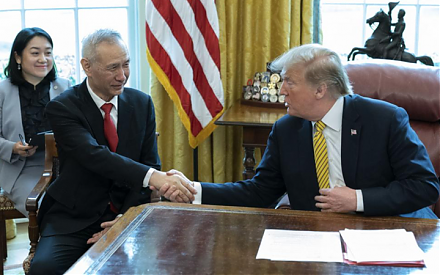

Chinese trade delegation offers to boost purchases of U.S. agricultural products to reach an interim trade deal with the Trump administration. Chinese Vice

2019-10-21 10:35:00 Monday ET

American state attorneys general begin bipartisan antitrust investigations into the market power and corporate behavior of central tech titans such as Apple