Ascena Retail Group, Inc., through its subsidiaries, operates as a specialty retailer of apparel for women and tween girls in the United States, Canada, and Puerto Rico. The company operates through four segments: Premium Fashion, Plus Fashion, Kids Fashion, and Value Fashion. It offers a range of merchandise, including apparel, accessories, footwear, and intimates; and lifestyle products comprising cosmetics and bedroom accessories. The company also offers casual clothing, career wear, dressy apparel, and active wear, as well as special occasion and classic apparel. Its principal brands comprise Ann Taylor, LOFT, dressbarn, Lane Bryant, Catherines, and Justice brands. The company also offers its products through its Websites, including anntaylor.com, LOFT.com, outlet.loft.com, louandgrey.com, dressbarn.com, lanebryant.com, catherines.com, and shopjustice.com. As of February 19, 2020, it operated approximately 2,800 stores. The company was formerly known as Dress Barn, Inc. and changed its name to Ascena Retail Group, Inc. in January 2011. Ascena Retail Group, Inc. was founded in 1962 and is based in Mahwah, New Jersey....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-02-25 12:41:00 Monday ET

Chicago financial economist Raghuram Rajan views communities as the third pillar of liberal democracy in addition to open markets and states. Rajan suggests

2017-12-19 09:39:00 Tuesday ET

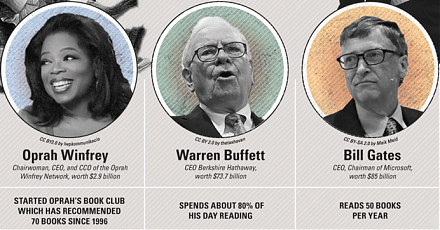

From Oprah Winfrey to Bill Gates, this infographic visualization summarizes the key habits and investment styles of highly successful entrepreneurs:

2019-12-19 14:43:00 Thursday ET

JPMorgan Chase CEO Jamie Dimon views wealth inequality as a major economic problem in America. Dimon now warns that the rich Americans have been getting wea

2019-12-28 09:36:00 Saturday ET

Global debt surges to $250 trillion in the fiscal year 2019. The International Institute of Finance analytic report shows that both China and the U.S. accou

2017-03-03 05:39:00 Friday ET

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.

2018-07-09 09:39:00 Monday ET

The Federal Reserve raises the interest rate again in mid-2018 in response to 2% inflation and wage growth. The current neutral interest rate hike neither b