2020-11-22 11:30:00 Sun ET

trust perseverance resilience empathy compassion passion purpose vision mission life metaphors seamless integration critical success factors personal finance entrepreneur inspiration grit

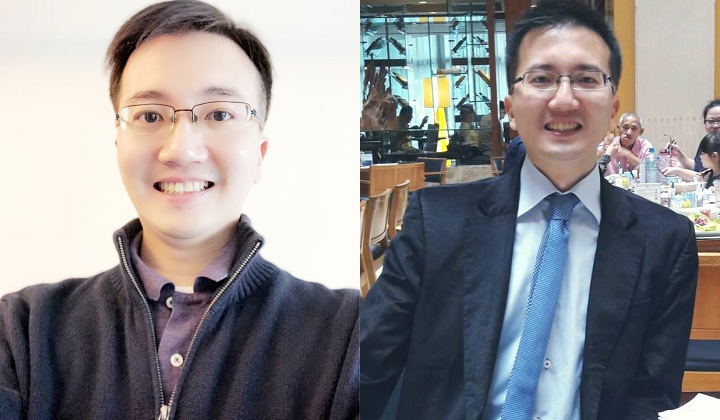

Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network platform ecosystem. Andy supports the core mission of promoting greater financial literacy, inclusion, and freedom of the global general public. Andy integrates multiple team efforts and endeavors to help enrich the economic lives of others. AYA fintech network platform provides fresh economic insights into stock market news, investment memes, business practices, personal finance tools, as well as generic life inspirations.

Andy implements the lean startup approach to incubating our AYA fintech network platform through iterative continuous improvements and feature enhancements. Andy serves as a financial economist, founder, as well as inventor of an algorithmic system for dynamic conditional asset return analysis and fintech network platform automation (U.S. patent publication #15480765 October 2018).

Andy has rich extensive international experiences in monetary, fiscal, and financial stability policies. His brainchildren or research publications appear in a reasonable range of both academic and professional journals in macro finance, asset return prediction, algorithmic factor quantification, cash capital structure, financial risk management, personal finance, and corporate ownership and governance.

Andy maintains a rich library of literature reviews, study notes, and mathematical exercises in investment theory and evidence, econometric theory, macroeconomic theory and evidence, empirical corporate finance, and both English and Chinese bible verses for Christian faith.

Prior to orchestrating our AYA fintech network platform as a new online social community for stock market investors, Andy has served as a financial economist at several international organizations in America, New Zealand, and Taiwan. These organizations include Academia Sinica, Bank of America, Federal Reserve Bank of San Francisco, Reserve Bank of New Zealand, Institute for Information Industry, Moody's Analytics, and so forth.

Andy was born and bred in Taipei; spent 12 years from high school to his first full-time job in New Zealand; studied and worked another 5 years from graduate school to a Vice President appointment in San Francisco, California, USA; and spent PhD and lean startup years in Taipei, Taiwan.

His lean enterprise Brass Ring International Density Enterprise (BRIDE) received first incorporation and registration in Hong Kong.

Andy holds several academic degrees and qualifications with scholarship support such as Doctor of Philosophy (PhD) candidacy in finance from National Taiwan University, Master of Financial Engineering (MFE) from the University of California at Berkeley, Master of Management Studies (MMS) and Bachelor of Management Studies (BMS) both with first-class honors from the University of Waikato, and Financial Risk Manager (FRM) global risk industry accreditation.

An up-to-date soft copy of Andy Yeh's curriculum vitae is available upon request.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

As of early-January 2023, the U.S. Patent and Trademark Office (USPTO) has approved our U.S. utility patent application: Algorithmic system for dynamic conditional asset return prediction and fintech network platform automation.

On 4 March 2021, we filed a U.S. patent continuation application (Application Number: #17192059; Publication Number: US20210192628) with a new set of claims in accordance with the April 2017 initial application (Application Number: #15480765; Publication Number: US20180293656).

We went through many USPTO office actions, rejections, failures, setbacks, and other technical obstacles. Eventually, our patent efforts came to fruition in time. We paid the USPTO maintenance fees to secure our patent protection and accreditation for 20 years.

Andy Yeh

AYA fintech network platform founder

Chief Financial Architect (CFA) and Financial Risk Manager (FRM)

Brass Ring International Density Enterprise (BRIDE)

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-11-07 09:38:00 Tuesday ET

HPE CEO Meg Whitman has run both eBay and Hewlett Packard within Fortune 500 and now has decided to step down after her 6-year stint at the technology giant

2019-04-27 16:41:00 Saturday ET

Tony Robbins suggests that one has to be able to make money during sleep hours in order to reach financial freedom. Most of our jobs and life experiences tr

2018-12-19 17:41:00 Wednesday ET

Tencent Music Entertainment debuts its IPO on NYSE to strike a chord with stock market investors. Tencent Music goes public and marks the biggest IPO by a m

2018-08-05 12:34:00 Sunday ET

JPMorgan Chase CEO Jamie Dimon sees great potential for 10-year government bond yields to rise to 5% in contrast to the current 3% 10-year Treasury bond yie

2019-10-11 13:40:00 Friday ET

Apple CEO Tim Cook maintains a frugal low-key lifestyle. With $625 million public wealth, Cook leads the $1 trillion tech titan Apple in the post-Jobs era.