Morgan Stanley Asia-Pacific Fund, Inc. (the Fund), is a non-diversified, closed-end management investment company. The Fund’s investment objective is long-term capital appreciation through investments primarily in equity securities of Asian-Pacific issuers and in debt securities issued or guaranteed by Asian Pacific governments or governmental entities. Its portfolio includes common stocks, warrants, and short-term investments, including repurchase agreements. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2018-03-23 08:26:00 Friday ET

Personal finance and investment author Thomas Corley studies and shares the rich habits of self-made millionaires. Corley has spent 5 years studying the dai

2022-02-15 14:41:00 Tuesday ET

Modern themes and insights in behavioral finance Lee, C.M., Shleifer, A., and Thaler, R.H. (1990). Anomalies: closed-end mutual funds. Journal

2018-08-17 11:45:00 Friday ET

In accordance with the extant corporate disclosure rules and requirements, all U.S. public corporations have to report their balance sheets, income statemen

2019-03-03 10:39:00 Sunday ET

Tech companies seek to serve as quasi-financial intermediaries. Retail traders can list items for sale on eBay and then acquire these items economically on

2018-12-21 11:39:00 Friday ET

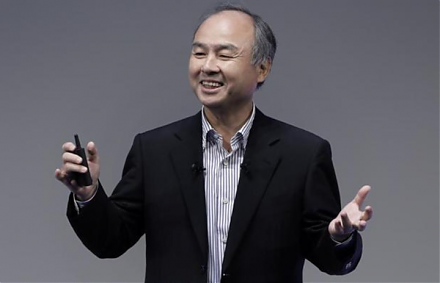

The Internet and telecom conglomerate SoftBank Group raises $23 billion in the biggest IPO in Japan. Going public is part of the major corporate move away f

2019-11-13 11:34:00 Wednesday ET

The new Brexit deal can boost British pound appreciation and economic optimism. British prime minister Boris Johnson wins the parliamentary vote on his new