Alder Biopharmaceuticals, Inc., incorporated on May 20, 2002, is a clinical-stage biopharmaceutical company. The Company discovers, develops and seeks to commercialize genetically engineered therapeutic antibodies with the potential to transform existing treatment paradigms. Alder's lead pivotal-stage product candidate, eptinezumab, is being evaluated for migraine prevention. Eptinezumab is a monoclonal antibody that inhibits calcitonin gene-related peptide (CGRP), a protein that is active in mediating the initiation of migraine. Alder is additionally evaluating ALD1910, a preclinical product candidate also in development as a migraine prevention therapy. ALD1910 is a monoclonal antibody that inhibits pituitary adenylate cyclase-activating polypeptide-38 (PACAP-38), another protein that is active in mediating the initiation of migraine. Clazakizumab, Alder's third program, is a monoclonal antibody candidate that inhibits interleukin-6 and is licensed to Vitaeris, Inc. ...

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 12 July 2025

2018-11-29 11:33:00 Thursday ET

A congressional division between Democrats and Republicans can cause ripple effects on Trump economic reforms. As Democrats have successfully flipped the Ho

2018-03-27 07:33:00 Tuesday ET

CNBC's business anchorwoman Becky Quick interviews Nobel Laureate Joseph Stiglitz on the current trade war between America and China. As America imposes

2018-12-15 14:38:00 Saturday ET

Google CEO Sundar Pichai makes his debut testimony before Congress. The post-mid-term-election House Judiciary Committee bombards Pichai with key questions

2018-07-17 08:35:00 Tuesday ET

Henry Paulson and Timothy Geithner (former Treasury heads) and Ben Bernanke (former Fed chairman) warn that people seem to have forgotten the lessons of the

2020-03-05 08:28:00 Thursday ET

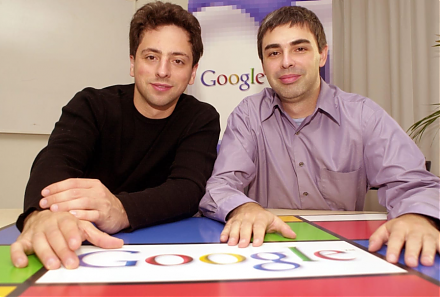

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s

2019-11-23 08:33:00 Saturday ET

MIT financial economist Simon Johnson rethinks capitalism with better key market incentives. Johnson refers to the recent Business Roundtable CEO statement