Allergan plc, a pharmaceutical company, develops, manufactures, and commercializes branded pharmaceutical, device, biologic, surgical, and regenerative medicine products worldwide. The company operates in three segments: US Specialized Therapeutics, US General Medicine, and International. It offers a portfolio of products in various therapeutic areas, including medical aesthetics and dermatology, eye care, neuroscience, urology, gastrointestinal, central nervous system, women's health, and anti-infective therapeutic products. The company also offers breast implants and tissue expanders; In addition, it develops medical and cosmetic treatments; treatments for neurodegenerative disorders; and inflammatory and fibrotic diseases. It has a collaboration, option, and license agreement with Lyndra, Inc. to develop orally administered products for the treatment of Alzheimer's disease; strategic alliance and option agreement with Editas Medicine, Inc.; and Allergan plc also has licensing agreements with Assembly Biosciences, Inc. The company was formerly known as Actavis plc and changed its name to Allergan plc in June 2015. Allergan plc was incorporated in 2013 and is headquartered in Dublin, Ireland....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2019-08-12 07:30:00 Monday ET

Facebook reaches a $5 billion settlement with the Federal Trade Commission over Cambridge Analytica user privacy violations. The Federal Trade Commission (F

2019-09-03 14:29:00 Tuesday ET

Due to U.S. tariffs and other cloudy causes of economic policy uncertainty, Apple, Nintendo, and Samsung start to consider making tech products in Vietnam i

2019-06-29 17:30:00 Saturday ET

Nobel Laureate Joseph Stiglitz proposes the primary economic priorities in lieu of neoliberalism. Neoliberalism includes lower taxation, deregulation, socia

2018-05-29 11:40:00 Tuesday ET

America and China, the modern world's most powerful nations may stumble into a **Thucydides trap** that Harvard professor and political scientist Graham

2019-03-17 14:35:00 Sunday ET

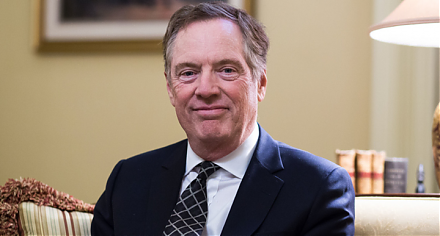

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2020-03-05 08:28:00 Thursday ET

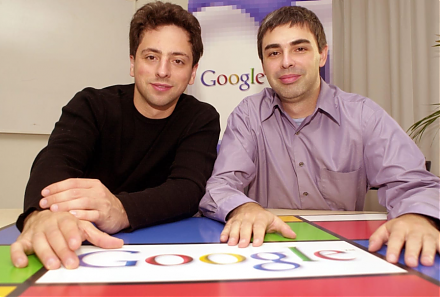

The Stanford computer science overlords Larry Page and Sergey Brin design and develop Google as an Internet search company. Janet Lowe (2009) Google s