AbbVie has become one of the top-most pharma companies after it acquired Allergan. The deal has transformed AbbVie's portfolio by lowering its dependence on Humira, its flagship product. AbbVie has one of the most popular cancer drugs in its portfolio, Imbruvica and its newest immunology drugs Skyrizi and Rinvoq position it well for long-term growth. AbbVie came into existence after Abbott Laboratories divested its pharmaceutical division. AbbVie enjoys leadership positions in key therapeutic areas including immunology, hematologic oncology, neuroscience, aesthetics, eye care and womens' health. Humira is approved for several autoimmune diseases like rheumatoid arthritis, active psoriatic arthritis, active ankylosing spondylitis, Crohn's disease and others. Imbruvica became part of the company's portfolio following the Pharmacyclics acquisition. Other key drugs include Venclexta, Botox Cosmetic, Botox Therapeutics, Vraylar, Skyrizi and Rinvoq....

+See MoreSharpe-Lintner-Black CAPM alpha (Premium Members Only) Fama-French (1993) 3-factor alpha (Premium Members Only) Fama-French-Carhart 4-factor alpha (Premium Members Only) Fama-French (2015) 5-factor alpha (Premium Members Only) Fama-French-Carhart 6-factor alpha (Premium Members Only) Dynamic conditional 6-factor alpha (Premium Members Only) Last update: Saturday 7 March 2026

2023-06-07 10:27:00 Wednesday ET

Anat Admati and Martin Hellwig raise broad critical issues about bank capital regulation and asset market stabilization. Anat Admati and Martin Hellwig (

2025-06-28 10:39:00 Saturday ET

Former New York Times science author and Harvard psychologist Daniel Goleman explains why great mental focus serves as a vital mainstream driver of personal

2019-08-22 11:35:00 Thursday ET

Fundamental factors often reflect macroeconomic innovations and so help inform better stock investment decisions. Nobel Laureate Eugene Fama and his long-ti

2019-08-24 14:38:00 Saturday ET

Warren Buffett warns that the current cap ratio of U.S. stock market capitalization to real GDP seems to be much higher than the long-run average benchmark.

2023-06-19 10:31:00 Monday ET

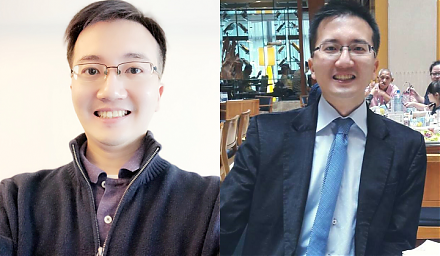

A brief biography of Dr Andy Yeh (PhD, MFE, MMS, BMS, FRM, and USPTO patent accreditation) Dr Andy Yeh is responsible for ensuring maximum sustainable me

2020-09-24 10:26:00 Thursday ET

Edge strategies help business leaders improve core products and services in a more cost-effective and less risky way. Alan Lewis and Dan McKone (2016)