2017-09-25 09:42:00 Monday ET

President Trump has allowed most JFK files to be released to the general public. This batch of documents reveals many details of the assassination of Presid

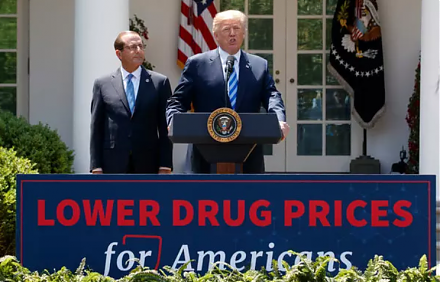

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2017-11-29 07:42:00 Wednesday ET

The octogenarian billionaire and activist investor Carl Icahn mulls over steps to shake up the board of SandRidge Energy after the oil-and-gas company adopt

2019-02-11 09:37:00 Monday ET

Corporate America uses Trump tax cuts and offshore cash stockpiles primarily to fund share repurchases for better stock market valuation. Share repurchases

2025-10-13 12:32:00 Monday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

2018-05-10 07:37:00 Thursday ET

Top money managers George Soros and Warren Buffett reveal their current stock and bond positions in their recent corporate disclosures as of mid-2018. Georg