2020-10-06 09:31:00 Tuesday ET

Strategic managers envision lofty purposes to enjoy incremental consistent progress over time. Allison Rimm (2015) The joy of strategy: a bu

2019-07-30 15:33:00 Tuesday ET

All of the 18 systemically important banks pass the annual Federal Reserve stress tests. Many of the largest lenders announce higher cash payouts to shareho

2018-04-20 10:38:00 Friday ET

Allianz chairman Mohamed El-Erian bolsters a new American economic paradigm in lieu of the Washington consensus. The latter dominates the old school of thou

2018-07-13 09:41:00 Friday ET

Yale economist Stephen Roach warns that America has much to lose from the current trade war with China for a few reasons. First, America is highly dependent

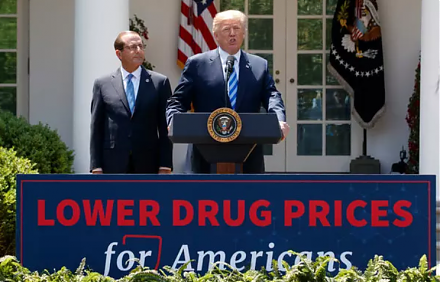

2018-05-07 07:32:00 Monday ET

President Trump seeks to honor his campaign promise of lower U.S. medical costs by forcing higher big-pharma prices in foreign countries such as Canada, Bri

2018-06-06 09:39:00 Wednesday ET

Donald Trump and Kim Jong Un meet, talk, and shake hands in the historic peace summit between America and North Korea in Singapore. At the start of the bila