2019-06-25 10:34:00 Tuesday ET

Investing in stocks is the best way for people to become self-made millionaires. A recent Gallup poll indicates that only 37% of young Americans below the a

2018-10-13 10:44:00 Saturday ET

Dow Jones tumbles 3% or 831 points while NASDAQ tanks 4%, and this negative investor sentiment rips through most European and Asian stock markets in early-O

2019-01-02 06:28:00 Wednesday ET

New York Fed CEO John Williams listens to sharp share price declines as part of the data-dependent interest rate policy. The Federal Reserve can respond to

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2018-10-15 09:33:00 Monday ET

Several pharmaceutical companies now switch their primary focus from generic prescription drugs to medical specialties such as cardiovascular medications an

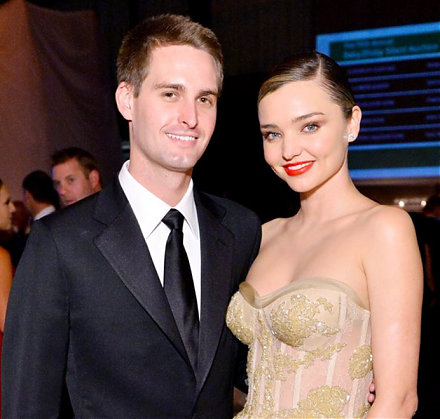

2017-03-03 05:39:00 Friday ET

As the biggest IPO since Alibaba in recent years, Snap Inc with its novel instant-messaging app SnapChat achieves $30 billion stock market capitalization.