2022-03-25 09:34:00 Friday ET

Corporate cash management The empirical corporate finance literature suggests four primary motives for firms to hold cash. These motives include the tra

2017-07-13 08:35:00 Thursday ET

President Donald Trump has announced that a major Apple iPhone upstream supplier, Foxconn Technology Group (aka Hon Hai Precision Group), will invest $10 bi

2020-04-10 11:33:00 Friday ET

Elon Musk envisions a bold fantastic future with his professional trifecta of lean startup enterprises SolarCity, SpaceX, and Tesla. Ashlee Vance (2015)

2018-06-08 13:35:00 Friday ET

The Federal Reserve delivers a second interest rate hike to 1.75%-2% and then expects subsequent rate increases in September and December 2018 to dampen inf

2019-09-23 12:25:00 Monday ET

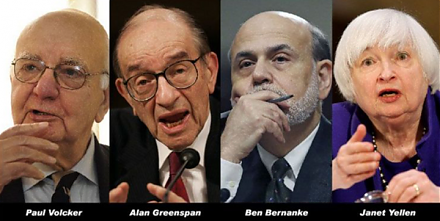

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2019-09-15 14:35:00 Sunday ET

U.S. Treasury officially designates China a key currency manipulator in the broader context of Sino-American trade dispute resolution. The U.S. Treasury cla