Our AYA fun podcasts deep-dive into the current global trends, topics, and issues in macro finance, political economy, public policy, strategic management, innovation, entrepreneurship, and broader technological advancement in artificial intelligence (AI), virtual reality (VR), electric vehicles (EV), autonomous robotaxis (AR), graphics processing units (GPU), cloud services, high-speed broadband networks, the metaverse, and many more.

We would like to share our current AYA podcasts in reverse chronological order.

$META $MSFT $AAPL $AMZN $GOOG $GOOGL $NVDA $TSLA $BRK.A $BRK.B $MELI $BABA $BIDU $C

$BAC $WFC $JPM $MS $GS $PNC $V $MA $AXP $TME $BILI $IQ $JD $PDD $NIO $T $VZ $TMUS $PYPL

$PLTR $CSCO $SNPS $NET $CRWD $IONQ $QBTS $QUBT $RGTI $AMD $QCOM $AVGO $ARM $KKR

These podcasts discuss the latest global trends, topics, and issues in macro finance, political economy, public policy, strategic management, innovation, entrepreneurship, and broader technological advancement in artificial intelligence (AI), virtual reality (VR), central bank digital currencies (CBDC), algorithmic asset management (Algo AM), recurrent and convolutional neural networks (RNN and CNN) for smart asset return prediction, electric vehicles (EV), autonomous robotaxis (AR), green power plants, cloud services, the metaverse, and many more.

Each fun podcast is about 10 minutes long (with AI podcast generation from Google NotebookLM).

In the broader context of stock market valuation, financial statement analysis, and smart-beta asset portfolio optimization, our AYA flagship podcasts, research surveys, research articles, literature reviews, analytic reports, ebooks, blog posts, and social media comments, discussions, and connections can help inform better stock market investment decisions for long-term investors, asset managers, hedge funds, investment banks, insurers, broker-dealers, and many other non-bank financial institutions and intermediaries (credit unions, building societies, and finance companies).

These better stock market investment decisions often lead to reasonably higher, more stable, more robust, and more profitable capital gains, cash dividends, and share repurchases in a cost-effective manner.

With U.S. fintech patent approval, accreditation, and protection for 20 years, our AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for stock market investors worldwide.

We build, design, and delve into our new and non-obvious proprietary algorithmic system for smart asset return prediction and fintech network platform automation. Unlike our fintech rivals and competitors who chose to keep their proprietary algorithms in a black box, we open the black box by providing the free and complete disclosure of our U.S. fintech patent publication. In this rare unique fashion, we help stock market investors ferret out informative alpha stock signals in order to enrich their own stock market investment portfolios. With no need to crunch data over an extensive period of time, our freemium members pick and choose their own alpha stock signals for profitable investment opportunities in the U.S. stock market.

Smart investors can consult our proprietary alpha stock signals to ferret out rare opportunities for transient stock market undervaluation. Our analytic reports help many stock market investors better understand global macro trends in trade, finance, technology, and so forth. Most investors can combine our proprietary alpha stock signals with broader and deeper macro financial knowledge to win in the stock market.

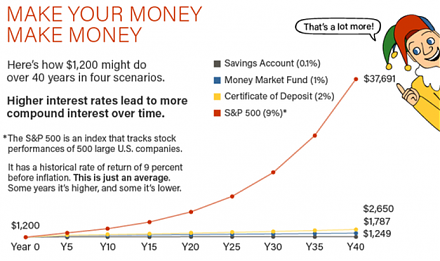

Through our proprietary alpha stock signals and personal finance tools, we can help stock market investors achieve their near-term and longer-term financial goals. High-quality stock market investment decisions can help investors attain the near-term goals of buying a smartphone, a car, a house, good health care, and many more. Also, these high-quality stock market investment decisions can further help investors attain the longer-term goals of saving for travel, passive income, retirement, self-employment, and college education for children. Our AYA fintech network platform empowers stock market investors through better social integration, education, and technology.

Today, tech titans, billionaires, serial entrepreneurs, and venture capitalists continue to reshape and even disrupt global pharmaceutical investments for both better healthspan and longer lifespan.

Artificial intelligence continues to reshape the current global market for better biotech advances, medical innovations, and healthcare services.

The global market for GLP-1 anti-obesity weight-loss treatments now grows substantially to benefit more than 1 billion people worldwide by 2030.

Is higher stock market concentration good or bad for Corporate America?

As he moves into his second term, President Trump continues to blame China for the long prevalent U.S. trade deficits and several other social and economic deficiencies.

Geopolitical alignment often reshapes and reinforces asset market fragmentation in the broader context of financial deglobalization.

The global cloud infrastructure helps accelerate the next high-tech revolutions in electric vehicles (EV), virtual reality (VR) headsets, artificial intelligence (AI) online services, and the metaverse.

The new homeland industrial policy stance tilts toward greater global resilience across the major high-tech supply chains worldwide.

China poses new threats to the U.S. and its western allies.

How can generative AI tools and LLMs help enhance human productivity?