2018-09-23 08:37:00 Sun ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Bank of America Merrill Lynch's chief investment strategist Michael Hartnett points out that U.S. corporate debt (not household credit supply or bank capital shortage) can cause the next financial crisis.

U.S. public corporations have gradually accumulated more than $6 trillion debt with low interest rates since the global financial crisis from 2008 to 2009. This corporate debt binge helps fund the recent recovery in new capital investment and equipment, full employment, and stock buyback in America.

Corporate default rates are minuscule, and U.S. companies now sit on hefty cash stockpiles primarily due to robust U.S. economic output gains and corporate tax cuts under the Trump administration. At some inflection point, however, economic growth and corporate income may start to slow down. U.S. companies then would have less firepower to pay back debt, and it is not easy for these companies to roll over their debt in due course. Debt-laden companies would be vulnerable to higher costs of capital as the Federal Reserve continues the current interest rate hike.

These high costs of capital can translate into a new corporate credit crunch, which adversely affects both employment and capital investment as the U.S. economy slides into an economic recession.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2020-02-19 14:35:00 Wednesday ET

The U.S. bank oligarchy has become bigger, more profitable, and more resistant to public regulation after the global financial crisis. Simon Johnson and

2018-04-13 14:42:00 Friday ET

Mike Pompeo switches his critical role from CIA Director to State Secretary in a secret visit to North Korea with no regime change as the North Korean dicta

2019-05-17 15:24:00 Friday ET

A Harvard MBA graduate Camilo Maldonado shares several life lessons and wise insights into personal finance. People can leverage stock market investments an

2019-03-17 14:35:00 Sunday ET

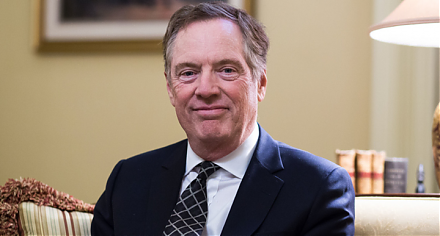

U.S. trade rep Robert Lighthizer proposes America to require regular touchpoints to ensure Sino-U.S. trade deal enforcement. America has to maintain the thr

2018-07-07 10:33:00 Saturday ET

The east-west tech rivalry intensifies between BATs (Baidu, Alibaba, and Tencent) and FAANGs (Facebook, Apple, Amazon, Netflix, and Google). These Sino-U.S.

2017-11-19 08:37:00 Sunday ET

In 2000, a former law professor at Harvard proposed establishing the Financial Product Safety Commission in order to protect consumer rights in the provisio