Home > Library > AYA analytic report on the top global tech risks May 2023

Author Andy Yeh Alpha

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Meta, Apple, Microsoft, Google, and Amazon (aka M.A.M.G.A.). As of Spring-Summer 2023, this macro report focuses on the current global risks from inflation and growth concerns to climate change and supply chain bottlenecks. In response to recent developments in green technology, climate change reforms help minimize the economic costs of both extreme weather catastrophes and other rare disasters. These prevalent climate change reforms require the use of essential technological advances in electric vehicles, hydropower plants, and other power storage systems. The new Biden Inflation Reduction Act and several other reforms help transform both inflation and growth concerns into better cushions against the socio-economic impact of inequality. Overall, this macro trend has profound public policy implications for U.S. tech titans Meta, Apple, Microsoft, Google, and Amazon.

Description:

Our fintech finbuzz analytic report shines fresh light on the fundamental prospects of U.S. tech titans Meta, Apple, Microsoft, Google, and Amazon (aka M.A.M.G.A.). As of Spring-Summer 2023, this macro report focuses on the current global risks from inflation and growth concerns to climate change and supply chain bottlenecks. In response to recent developments in green technology, climate change reforms help minimize the economic costs of both extreme weather catastrophes and other rare disasters. These prevalent climate change reforms require the use of essential technological advances in electric vehicles, hydropower plants, and other power storage systems. The new Biden Inflation Reduction Act and several other reforms help transform both inflation and growth concerns into better cushions against the socio-economic impact of inequality. Overall, this macro trend has profound public policy implications for U.S. tech titans Meta, Apple, Microsoft, Google, and Amazon.

AYA fintech network platform provides proprietary alpha stock signals and personal finance tools for U.S. stock market investors and traders. Our quantitative analysis accords with the standard approach to discounting-cash-flows (DCF) and free-cash-flows (FCF) corporate valuation.

This analytic report cannot constitute any form of financial advice, analyst opinion, recommendation, or endorsement. We refrain from engaging in financial advisory services, and we seek to offer our analytic insights into the latest economic trends, stock market topics, investment memes, and other financial issues. Our proprietary alpha investment algorithmic system helps enrich our AYA fintech network platform as a new social community for stock market investors: https://ayafintech.network.

We share and circulate these informative posts and essays with hyperlinks through our blogs, podcasts, emails, social media channels, and patent specifications. Our goal is to help promote better financial literacy, inclusion, and freedom of the global general public. While we make a conscious effort to optimize our global reach, this optimization retains our current focus on the American stock market.

This analytic report shares new economic insights, investment memes, and stock portfolio strategies through both blog posts and patent specifications on our AYA fintech network platform. AYA fintech network platform is every investor's social toolkit for profitable investment management. We can help empower stock market investors through technology, education, and social integration.

2020-04-17 07:23:00 Friday ET

Clayton Christensen defines and delves into the core dilemma of corporate innovation with sustainable and disruptive advances. Clayton Christensen (2000)

2019-02-06 10:36:49 Wednesday ET

President Trump delivers his second state-of-the-union address to U.S. Congress. Several key themes emerge from this presidential address. First, President

2019-03-19 12:35:00 Tuesday ET

U.S. tech titans increasingly hire PhD economists to help solve business problems. These key tech titans include Facebook, Amazon, Microsoft, Google, Apple,

2024-07-31 09:28:00 Wednesday ET

In the modern monetary system, each new CBDC helps anchor public trust in money in support of economic welfare, especially in a cashless society. In our

2020-06-24 09:32:00 Wednesday ET

Several business founders and entrepreneurs take low risks with high potential rewards to buck the conventional wisdom. Renee Martin and Don Martin (2010

2017-10-21 08:45:00 Saturday ET

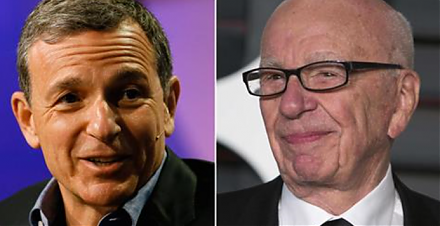

Netflix stares at higher content costs as Disney and Fox hold merger talks. Disney has held talks to acquire most of 21st Century Fox's business equity.