2019-06-29 17:30:00 Sat ET

stock market competition macrofinance stock return s&p 500 financial crisis financial deregulation bank oligarchy systemic risk asset market stabilization asset price fluctuations regulation capital financial stability dodd-frank

Nobel Laureate Joseph Stiglitz proposes the primary economic priorities in lieu of neoliberalism. Neoliberalism includes lower taxation, deregulation, social welfare minimalism, and less government intervention. This ideology has become the root cause of socioeconomic problems such as wage stagnation, income and wealth inequality, market power concentration, and environmental degradation.

In response, Stiglitz recommends 3 major economic policy prescriptions. First, the benevolent social planner should better balance free markets, civil communities, and state mechanisms. The government better shapes and facilitates markets and communities by investing in basic research, technology, high education, affordable health care, and infrastructure. This public investment pays well in terms of more connective communities and market mechanisms.

Second, wealth creation arises from scientific inquiry and social organization that collectively allow people to work together for the common good. Free markets still facilitate most social cooperation, but they serve this major purpose only if market participants are subject to democratic checks and balances and the rule of law.

Third, the government can curb corporate rent protection that might emerge from information advantages, hostile takeovers, or other entry barriers. The government has to sever the nexus between market power and political influence. The current public investment reform should focus on higher education, research, technology, affordable health care, and infrastructure.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2019-01-10 17:31:00 Thursday ET

The recent Bristol-Myers Squibb acquisition of American Celgene is the $90 billion biggest biotech deal in history. The resultant biopharma goliath would be

2017-11-23 10:42:00 Thursday ET

As the TV host of Mad Money, Jim Cramer provides 5 key reasons against the purchase and use of cryptocurrencies such as Bitcoin. First, no one knows the ano

2018-06-14 10:35:00 Thursday ET

The Federal Reserve's current interest rate hike may lead to the next economic recession as credit supply growth ebbs and flows through the business cyc

2025-01-22 08:35:08 Wednesday ET

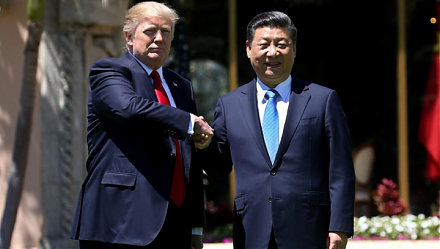

President Donald Trump blames China for the long prevalent U.S. trade deficits and several other social and economic deficiencies. In recent years, Pres

2019-01-04 11:41:00 Friday ET

Chinese President Xi JingPing calls President Trump to reach Sino-American trade conflict resolution. Xi sends a congratulatory message to mark 40 years sin

2019-07-29 11:33:00 Monday ET

Blackrock asset research director Andrew Ang shares his economic insights into fundamental factors for global asset management. As Ang indicates in an inter