Home > Library

2026-10-01This report delves into how today tech titans reshape global pharmaceutical investments for both better healthspan and longer lifespan.

2026-07-01This report delves into American exceptionalism and economic growth outperformance both by historical standards and in comparison to the rest of the world in recent decades.

2026-04-01This article delves into AI-driven new medications, treatments, therapies, and healthcare services worldwide.

2026-03-14This ebook delves into the fundamental analysis of new competitive advantages in many global macro industries.

2026-01-01This report delves into the key lessons from recent monetary policy framework reviews worldwide.

2025-10-15This ebook delves into the AI-driven comprehensive fundamental analysis of each of the top 20 tech titans in terms of their competitive advantages, economic moats, and technological innovations.

2025-10-01This report delves into the technological advances in the global market for GLP-1 anti-obesity weight-loss medications.

2025-09-11This ebook delves into the fundamental analysis of new competitive advantages in many global macro industries.

2025-08-15This ebook sums up the top-tier self-improvement book reviews for the growth mindset, personal growth, emotional intelligence, and life purpose etc.

2025-07-01Geopolitical alignment often reshapes and reinforces asset market fragmentation in the broader context of financial deglobalization.

2025-09-28 10:10:51 Sunday ET

Stock Synopsis: With a new Python program, we use, adapt, apply, and leverage each of the mainstream Gemini Gen AI models to conduct this comprehensive fund

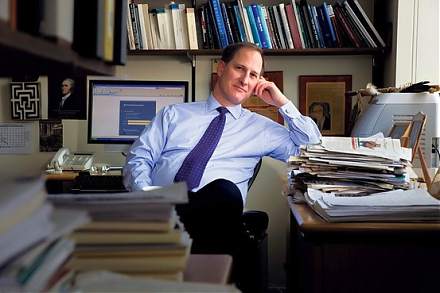

2023-04-14 13:32:00 Friday ET

Calomiris and Haber delve into the comparative analysis of bank crises and politics in America, Britain, Canada, Mexico, and Brazil. Charles Calomiris an

2023-08-21 12:25:00 Monday ET

Steven Shavell presents his economic analysis of law in terms of the economic outcomes of both legal doctrines and institutions. Steven Shavell (2004)

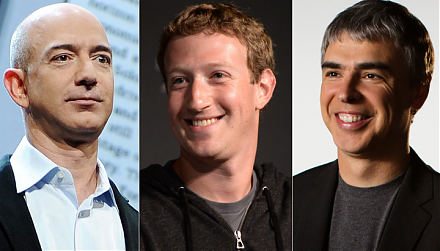

2018-11-19 09:38:00 Monday ET

The Trump administration mulls over antitrust actions against Amazon, Facebook, and Google. President Trump indicates that the $5 billion fine against Googl

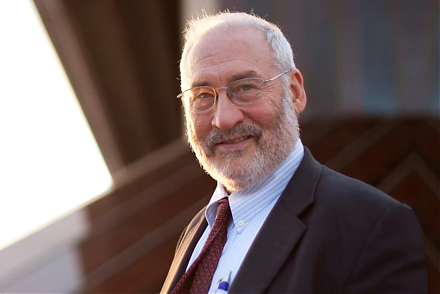

2023-07-21 10:30:00 Friday ET

Joseph Stiglitz and Andrew Charlton suggest that free trade helps promote better economic development worldwide. Joseph Stiglitz and Andrew Charlton (200

2022-05-05 09:34:00 Thursday ET

Corporate payout management This corporate payout literature review rests on the recent survey article by Farre-Mensa, Michaely, and Schmalz (2014). Out