Home > Library

2017-08-07This book presents many useful mathematical exercises in postgraduate macroeconomic theory and practice.

2016-08-07This book provides many useful mathematical exercises in graduate econometric theory and practice.

2015-08-07This ebook surveys most contemporary topics and issues in modern asset pricing model design and empirical corporate finance.

2013-06-06This research article proposes a new algorithmic model for credit portfolio segmentation.

2012-12-12This research article empirically shows the mysterious and inexorable nexus between credit default swap spreads and interest rate surprises.

2010-06-06This research article empirically implements the novel and non-obvious credit risk model CreditGrades.

2010-03-03This research article explains the topical issues in home-host operational risk management under the Basel bank capital regime.

2010-02-02This research article provides our mathematical analysis of the gradual evolution of corporate ownership concentration around the world.

2010-01-01This research article empirically assesses the financial contentment hypothesis for small business owners.

2020-05-28 15:37:00 Thursday ET

Platform enterprises leverage network effects, scale economies, and information cascades to boost exponential business growth. Laure Reillier and Benoit

2017-12-01 06:30:00 Friday ET

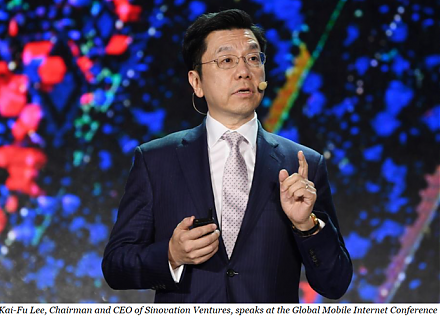

Dr Kai-Fu Lee praises China as the next epicenter of artificial intelligence, smart data analysis, and robotic automation. With prior IT careers at Apple, M

2019-08-26 11:30:00 Monday ET

Partisanship matters more than the socioeconomic influence of the rich and elite interest groups. This new trend emerges from the recent empirical analysis

2018-09-25 10:35:00 Tuesday ET

Sirius XM pays $3.5 billion shares to acquire the music app company Pandora. This acquisition would form the largest audio entertainment company worldwide.

2020-06-03 09:31:00 Wednesday ET

Lean enterprises often try to incubate disruptive innovations with iterative continuous improvements and inventions over time. Trevor Owens and Obie Fern

2019-07-09 15:14:00 Tuesday ET

The Chinese new star board launches for tech firms to list at home. The Nasdaq-equivalent new star board serves as a key avenue for Chinese tech companies t