Home > Library > Algorithmic credit portfolio segmentation

Author Andy Yeh Alpha

This research article proposes a new algorithmic model for credit portfolio segmentation.

Description:

Under the new Basel bank capital framework, each bank must group its retail exposures into multiple segments with homogeneous risk characteristics. The U.S. regulatory agencies believe that each bank may use its internal risk models for the loan-level risk parameter estimates such as probability of default (PD) and loss given default (LGD) to group individual exposures into the resultant segments with homogeneous risk attributes. In stark contrast to the conventional decision-tree method, we propose a new algorithmic technique for retail consumer loan portfolio segmentation. This new technique identifies the optimal number of segments, sorts the individual loan exposures into the various segments, and then leads to the minimal degree of risk heterogeneity in comparison to the baseline equal-bin and quantile-bin schemes. Furthermore, we analyze the Monte Carlo implicit asset correlation values for the retail loan segments over time to help assess the implications for bank capital measurement. The best-fit method for retail credit portfolio segmentation results in some capital relief that serves as an economic incentive for the bank to invest in this alternative segmentation. This positive outcome accords with the core principle of statistical conservatism that the financial econometrician enshrines in the Basel regulatory requirements for bank capital measurement.

2019-09-23 12:25:00 Monday ET

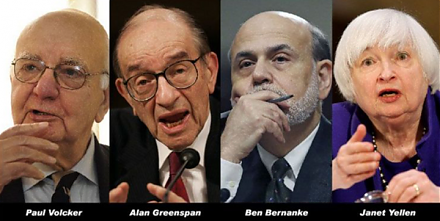

Volcker, Greenspan, Bernanke, and Yellen contribute to a Wall Street Journal op-ed on monetary policy independence. These former Federal Reserve chiefs unit

2017-11-07 09:38:00 Tuesday ET

HPE CEO Meg Whitman has run both eBay and Hewlett Packard within Fortune 500 and now has decided to step down after her 6-year stint at the technology giant

2019-02-04 07:42:00 Monday ET

Federal Reserve remains patient on future interest rate adjustments due to global headwinds and impasses over American trade and fiscal budget negotiations.

2019-03-21 12:33:00 Thursday ET

Senator Elizabeth Warren proposes breaking up key tech titans such as Facebook, Apple, Microsoft, Google, and Amazon (FAMGA). These tech titans have become

2017-06-15 07:32:00 Thursday ET

President Donald Trump has discussed with the CEOs of large multinational corporations such as Apple, Microsoft, Google, and Amazon. This discussion include

2021-05-20 10:30:00 Thursday ET

Artificial intelligence, 5G, and virtual reality can help transform global trade, finance, and technology. Core trade technological advances and disruptive