2019-12-16 11:37:00 Mon ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

America and China cannot decouple decades of long-term collaboration in trade, finance, and technology. In recent times, some economists claim that China may attempt to decouple decades of trade collaboration with the U.S. due to better tech supremacy on the eastern front. Several other economists further claim that China may try to revamp financial services and technological innovations well ahead of America.

Goldman Sachs chief strategy officer Stephanie Cohen indicates that these claims are overdone. In fact, Goldman continues to pursue fresh business opportunities in China after at least 2 decades of investment bank penetration there. In recent years, Goldman Sachs invests $60 million to bail out many depositors in Chinese brokerage firm Hainan Securities, which offers rich political connections in the one-party regime. Moreover, Goldman Sachs receives official approval from the China Securities Regulatory Commission (CSRC) to boost its equity stakes in Goldman Sachs Gao Hua Securities to the maximum cap of 51% from 33%. With managerial control over the joint venture, Goldman Sachs retains a key competitive advantage over its rivals such as JPMorgan Chase, UBS, and Nomura etc. This competitive edge empowers Goldman Sachs to further invest in Sino-American trade, finance, and technology in light of the new bilateral fair trade agreement.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-04-13 10:42:00 Thursday ET

President Donald Trump unveils the dramatic *tax overhaul proposal*. Through this tax plan, Trump replaces the current 7 income tax brackets with 3 leane

2019-06-11 12:33:00 Tuesday ET

Dallas Federal Reserve Bank President Robert Kaplan expects the U.S. economy to grow at 2.2%-2.5% in 2019-2020 as inflation rises a bit. In an interview wit

2018-08-15 14:40:00 Wednesday ET

Senator Elizabeth Warren advocates the alternative view that most U.S. trade deals serve corporate interests over workers, customers, and suppliers etc. She

2019-08-22 11:35:00 Thursday ET

Fundamental factors often reflect macroeconomic innovations and so help inform better stock investment decisions. Nobel Laureate Eugene Fama and his long-ti

2023-06-19 10:31:00 Monday ET

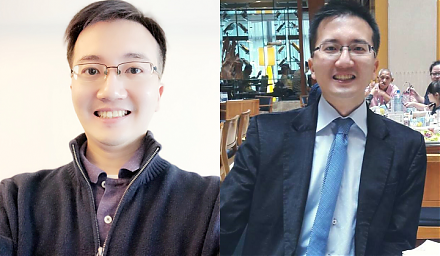

A brief biography of Andy Yeh Andy Yeh is responsible for ensuring maximum sustainable member growth within the Andy Yeh Alpha (AYA) fintech network plat

2019-07-05 09:32:00 Friday ET

Warwick macroeconomic expert Roger Farmer proposes paying for social welfare programs with no tax hikes. The U.S. government pension and Medicare liabilitie