2019-09-05 09:26:00 Thu ET

technology antitrust competition bilateral trade free trade fair trade trade agreement trade surplus trade deficit multilateralism neoliberalism world trade organization regulation public utility current account compliance

Yale macro economist Stephen Roach draws 3 major conclusions with respect to the Chinese long-run view of the current tech trade conflict with America. First, the Chinese Xi administration would never lose legitimacy due to subpar 5.5%-to-6.3% real GDP economic growth. China retains more fiscal and monetary policy levers than global growth headwinds. Second, Chinese hawkish hardliners remain patient and methodical when they deal with external wildcards. These external wildcards include U.S. partisanship and economic policy uncertainty, Brexit trade and capital exodus, and diplomatic outrage in the South China Sea.

Third, the 5G tech titan HuaWei is a big deal and national champion for China. As China seeks to trudge on the long march toward tech supremacy, U.S. tech trade strategists should consider alternative approaches instead of the current legalistic approach to Sino-U.S. trade conflict resolution. It would be a symbolic loss of state dignity and sovereignty for China to agree to signing into law U.S. trade terms and conditions on intellectual property protection and enforcement. Alternatively, U.S. trade reps should focus on direct dispute negotiations between U.S. and Chinese tech corporations through the extant inland and international arbitration tribunals. This alternative mechanism may nevertheless favor domestic firms in China.

If any of our AYA Analytica financial health memos (FHM), blog posts, ebooks, newsletters, and notifications etc, or any other form of online content curation, involves potential copyright concerns, please feel free to contact us at service@ayafintech.network so that we can remove relevant content in response to any such request within a reasonable time frame.

2017-06-09 06:37:00 Friday ET

To complement President Trump's pro-business economic policies such as low taxation, new infrastructure, greater job creation, and technological in

2017-03-27 06:33:00 Monday ET

Goldman Sachs chief economist Jan Hatzius says the Federal Reserve's QE exit strategy makes sense ahead of Fed Chair Janet Yellen's stepdown in 2018

2019-08-05 13:30:00 Monday ET

China continues to sell U.S. Treasury bonds amid Sino-U.S. trade truce uncertainty. In mid-2019, China reduces its U.S. Treasury bond positions by $20.5 bil

2018-05-15 08:40:00 Tuesday ET

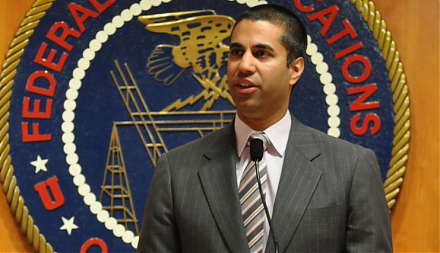

Net neutrality rules continue to revolve around the Trump administration's current IT agenda of 5G telecom transformation. Republican Senate passes the

2019-12-28 09:36:00 Saturday ET

Global debt surges to $250 trillion in the fiscal year 2019. The International Institute of Finance analytic report shows that both China and the U.S. accou

2019-11-13 11:34:00 Wednesday ET

The new Brexit deal can boost British pound appreciation and economic optimism. British prime minister Boris Johnson wins the parliamentary vote on his new